“Vampire attack” is a strategy used by a new blockchain project to quickly attract users and funds from a more popular competitor app. How does it work? What happened to Uniswap? Let’s take a look together!

Typically, the creators of a new app present a product with features similar to the “original,” but offer more lucrative incentives through rewards of their own token to its users.

In the fall of 2020, the decentralized exchange Uniswap was the target of a vampire attack, and in January 2022, the NFT-marketplace OpenSea.

What is the essence of a vampire attack?

A typical vampire attack has three components:

- Find a lead project.

- Create a counterpart, using the business model, architecture, or code of the original.

- Make redundant economic incentives the main difference from the popular competitor.

This strategy should result in the new project “sucking” users and their capital out of the target, a popular protocol.

The vampire attack strategy originated in decentralized finance (DeFi). The source code of DeFi applications, or a major part of it, is usually open source. Thus, a similar application is quite easy to copy and run with only minor changes.

In addition, the developers of the “copy” can easily produce their own control tokens and use it to inflate the profitability of liquidity farming, which is a standard way of earning for users.

How did Uniswap fall victim to a vampire attack?

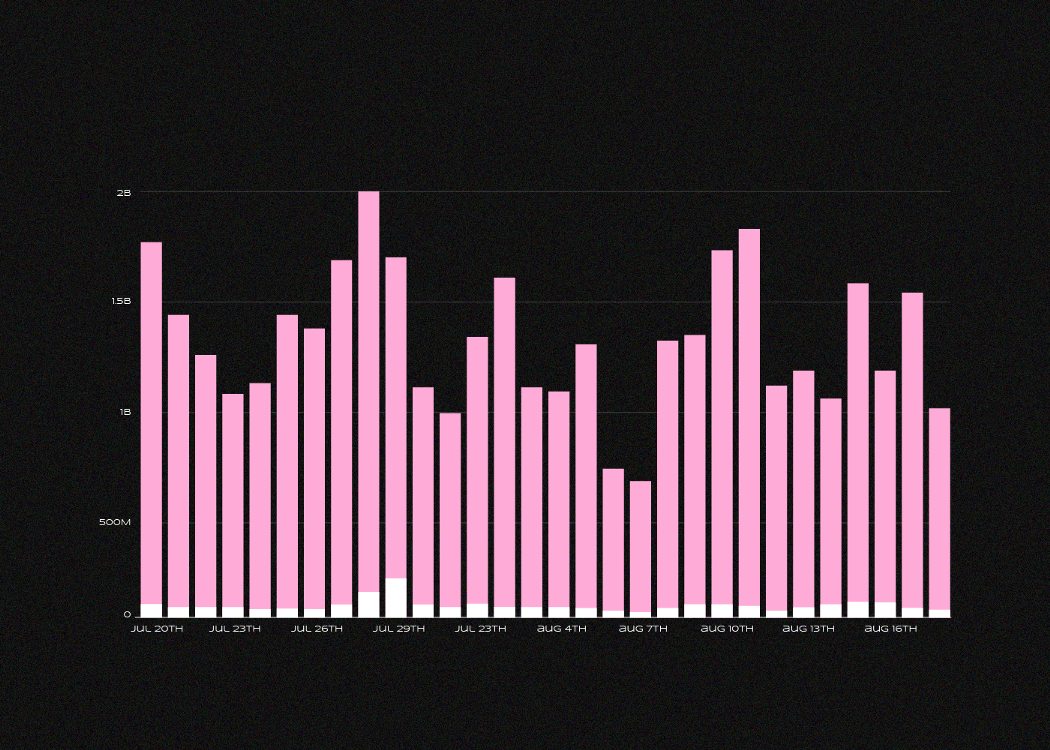

In 2020, the DeFi space, the decentralized exchange Uniswap began rapidly gaining popularity. The protocol’s daily trading volume had reached $1.8 billion by early September 2020, which was comparable to the leading centralized cryptocurrency trading platforms.

SushiSwap emerged against this backdrop. The fact that the new protocol was a fork of Uniswap was made clear by its anonymous creators. SushiSwap, on the other hand, had a significant difference: its own token SUSHI, which users received as a reward for farming in pools.

Despite the fact that almost every decentralized exchange now has a management token, it was not common practice at the time. DeFi, on the other hand, already had examples of their effectiveness as an economic incentive.

The SushiSwap team provided attractive terms for liquidity providers: participation in exchange pools brought hundreds or even thousands of percent per year thanks to SUSHI rewards. As a result of the vampire attack, Uniswap users transferred over $1 billion in funds to SushiSwap in just a few weeks, reducing the “original “ ‘s’ blocked liquidity (TVL) by 70%.

This situation, however, did not last long: the high farming rate of SUSHI caused a sharp increase in its price, causing the yield in SushiSwap pools to decrease just as quickly. In terms of TVL, Uniswap had already returned to the DeFi leaders by mid-September. Soon after, the UNI management token appeared, effectively negating SushiSwap’s advantage.

Trading volume on Uniswap (pink) and SushiSwap (white) from July 20 to August 18, 2022. Data: Dune Analytics

How did the vampire attack on OpenSea take place in 2022?

Another victim of “vampires” was the NFT-marketplace OpenSea, which handles the majority of non-exchangeable token trading.

LooksRare, another NFT trading platform, went live in early 2022. Although, unlike SushiSwap, its creators did not copy OpenSea smart contracts but instead wrote their own, the main component of their attack was also a platform token called LOOKS.

Users who traded NFT on LooksRare were rewarded for their LOOK activity. Only those who traded on OpenSea for 3 ETH or more between June and December 2021 were eligible to participate in the giveaway.

Users who traded NFT on LooksRare received rewards for their activity in LOOK. But there was one condition: only those who traded on OpenSea from June to December 2021 for 3 ETH or more could participate in the giveaway.

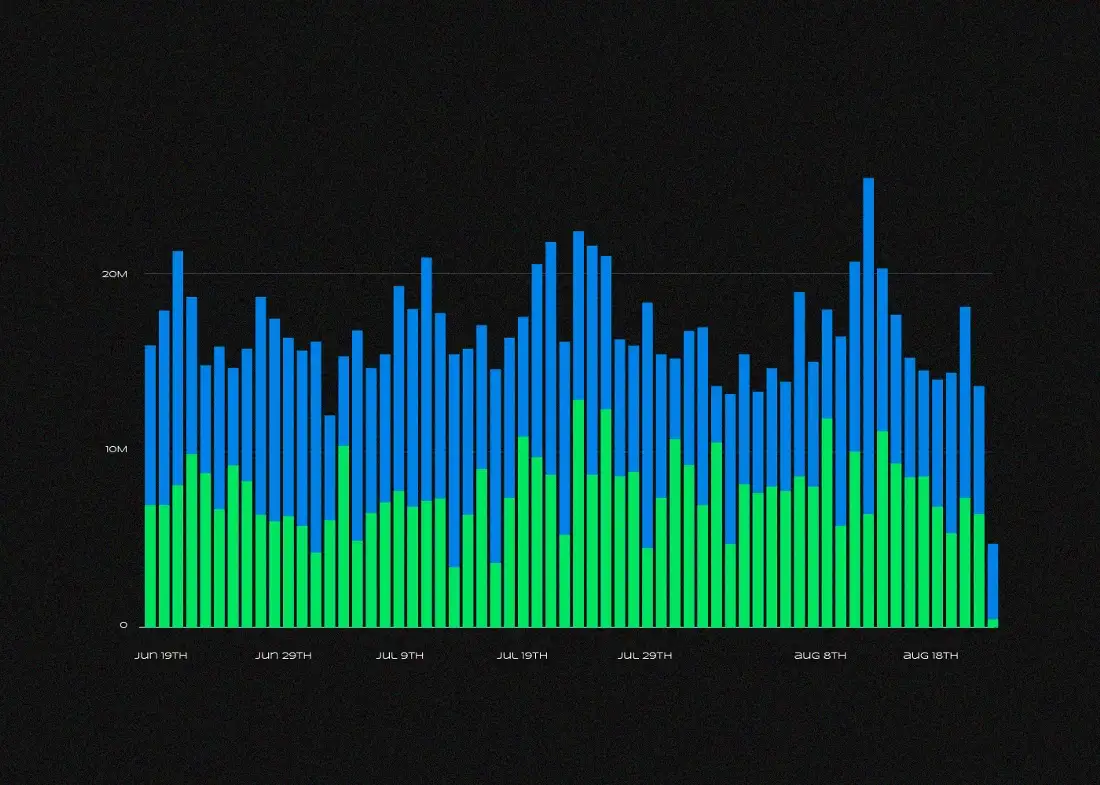

In addition to this “promotion,” users of the new platform may be able to obtain LOOKS through Staking at a yield of approximately 500% per year. Furthermore, the transaction fees on LooksRare were lower. The vampire attack resulted in a rapid increase in trading volume on LooksRare and a decrease on OpenSea.

At the same time, LooksRare trailed its competitor in terms of active users. Given the comparable volume of trades, researchers assumed that the few users of the new marketplace actively engage in wash trading, which is the practice of conducting a large number of fictitious transactions for the sake of LOOKS rewards. According to a CryptoSlam report, by early April, the share of fake transactions in total trading volume on LooksRare had reached 95%.

The site then changed incentives and began cracking down on unscrupulous practices, which led to a drop in activity. According to The Block, the amount of transactions fell from $69 million on May 1, 2022, to just $1 million on August 15, while the share of fake trades fell from 98% to 13% over the same period. At the same time, OpenSea regained its leadership in the NFT market.

Notably, the Marketplace has already been vampire attacked by the Infinity platform in 2021.

All Comments