From CoinShares Research Blog by James Butterfill

Recent price fall lead to significant buying on weakness with inflows of US$1.3bn

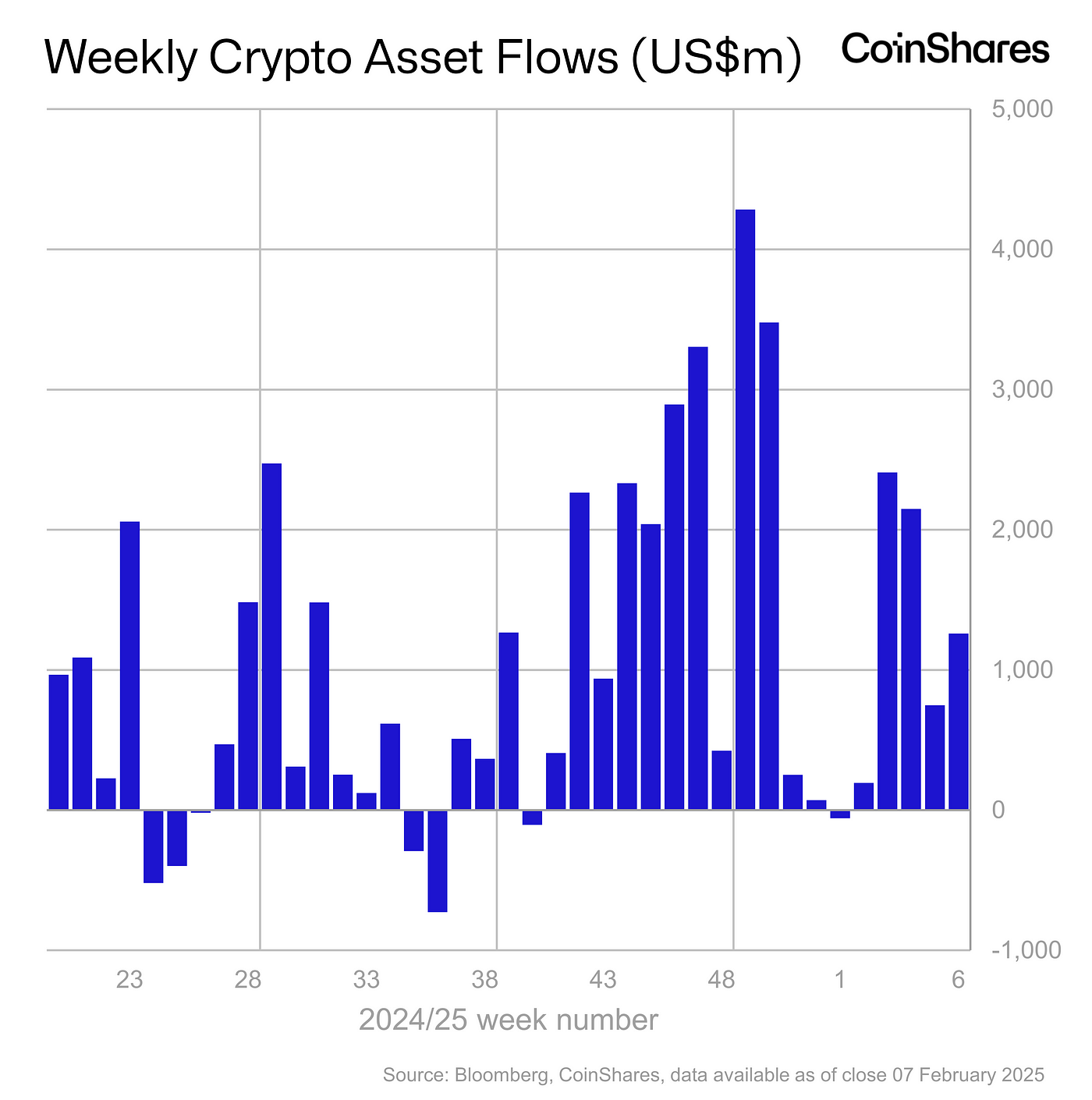

- Digital asset investment products saw inflows totalling for the 5th consecutive week totalling US$1.3bn.

- Bitcoin saw inflows of US$407m, with ETPs globally now representing 7.1% of the current market capitalisation.

- Ethereum stole the show this week, with the price falling recently close to US$2,100 leading to significant buying-on-weakness, with inflows of US$793m.

Digital asset investment products saw inflows totalling for the 5th consecutive week totalling US$1.3bn, bring inflows for the year so far to US$7.3bn. Recent price declines saw total assets under management in ETPs fall to US$163bn, down from its all-time-high set late January of US$181bn. Trading volumes for the week held steady at US$20bn.

Regionally, the US saw US$1bn inflows, although the buying-on-weakness was widespread with most other regions seeing inflows, most notable being Germany, Switzerland and Canada with inflows of US$61m, US$54m and US$37m respectively.

Bitcoin saw inflows of US$407m, with ETPs globally now representing 7.1% of the current market capitalisation, making them the largest holder relative to any other entity.

Ethereum stole the show this week, with the price falling recently close to US$2,100 leading to significant buying-on-weakness with inflows of US$793m, outpacing bitcoin for the first time this year.

Other notable inflows were XRP and Solana which saw US$21m and US$11m respectively.

Blockchain equities saw a further US$33m inflows bring year-to-date inflows to US$194m.

All Comments