From coinshares

Introduction

There are many possible paths that bitcoin might take to become a more adopted form of money. This article unpacks a particularly promising pathway: the role of stablecoin ownership as a stepping stone to bitcoin.

For long-term investors, the limited supply of bitcoin makes identifying sustainable sources of demand a primary concern. Understanding why and how such demand could emerge helps shape the expectation of value bitcoin could reasonably capture over time. So if adoption is what matters, we focus here on how a growing segment of the population might come to consider and ultimately allocate to bitcoin.

Specifically, we’re looking at the dramatic rise of stablecoin usage, the user experience burden limiting bitcoin’s adoption, and the role that stablecoins can play to bridge the gap.

Background

It is clear to us that individuals already using stablecoins are more susceptible than others to end up using bitcoin. After using a similar suite of underlying technologies and access vehicles, and having already made the decision to exchange their assets for “crypto dollars”, the additional decision to then buy bitcoin almost certainly carries less friction.

The main difference is the comfort level with crypto companies, infrastructure and software. This familiarity not only helps facilitate the discovery and access to bitcoin, but also simplifies the learning curve associated with its native use. Additionally, stablecoin owners are often already speculating on the best available monies to hold, making them prime candidates for considering a bitcoin investment.

For these reasons, we believe users’ experience with stablecoins lowers the barriers to enter Bitcoin, and we anticipate this kind of user journey becoming more common.

There are several existing factors we’ve observed shaping this view: a widespread lack of understanding Bitcoin’s characteristics and potential, the global desire for dollar access, the continuing surge in stablecoin usage, and the tendency for access vehicles to closely tie bitcoin, stablecoins, and local currency together in a single user experience. Each of these, we think either widens the potential size of, or brings individuals closer to, the stablecoin-to-bitcoin adoption gateway.

Moving forward, we’ll continue to discuss why we find stablecoin users are likely candidates to own bitcoin, and why we see it as an increasingly relevant path toward greater bitcoin adoption.

The Role of Stablecoins in Cryptocurrency Adoption

Before settling into the details, it is worth recapping the unique success stablecoins have had in the past few years.

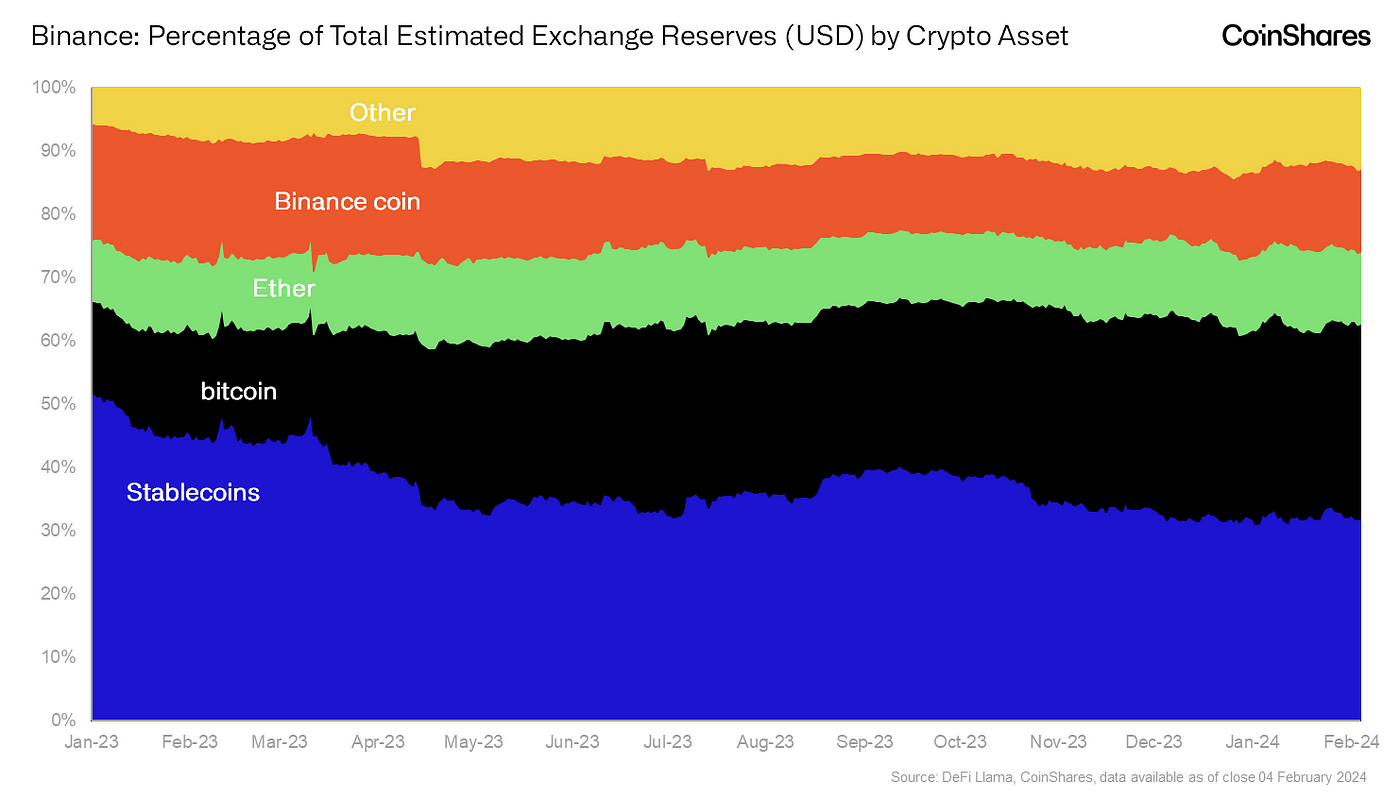

Stablecoins have emerged as arguably the predominant use case of generalised cryptocurrency systems, accounting for about 10% of the total crypto asset market size while driving about 70% of the total on-chain transaction volume. In just the last four years, their market size has experienced a tenfold increase to over $130 billion, with transaction volumes nearing a third of Visa’s $14 trillion in 2023. Impressively, their significance extends with the largest stablecoin issuer now holding $80 billion worth of US treasury bonds, overnight reverse repos, and money market funds, ranking them within the top 25 largest foreign holders of US debt.

We have witnessed a shift in users’ preference towards stablecoins for value preservation and diversification, especially outside western countries and in markets with volatile local currencies. Moyo Sodipo, founder of Nigerian crypto exchange Busha has spoken on this trend, observing a move from bitcoin speculation to a balanced approach between bitcoin and stablecoins, driven by a need to hedge against local currency debasement.

“When Busha gained popularity around 2019 and 2020, there was a big frenzy for Bitcoin. A lot of people were not initially keen on stablecoins. Now that Bitcoin has lost a lot of its value, there is a desire for diversification between Bitcoin and stablecoins. However, market shifts aren’t dampening activity. People are constantly looking for opportunities to hedge against the devaluation of the Naira and the persistent economic decline since COVID.”

- Moyo Sodipo, Chainalysis 2023 Geography of Cryptocurrency Report

Stablecoins continue to offer US Dollar stability while both the cryptocurrency and monetary markets fluctuate at higher volatility, making them a promising development for the crypto industry achieving broader adoption and integration with the traditional financial system. Rather than competing with the adoption of bitcoin, we view these developments, should they progress, as an accelerant that spreads bitcoin knowledge, helping attract the next class of owners.

Bitcoin’s Significant Learning Curve is Discouraging for New Users

Fifteen years into existence, Bitcoin has entered a new stage of its discovery. It is now widely recognised, yet it is still not commonly understood. A 2022 survey put out by the Block involving 10,000 adults worldwide revealed that while 88% were aware of bitcoin, 51% didn’t purchase it due to insufficient knowledge.

For those already versed in Bitcoin, this knowledge gap likely isn’t surprising. Bitcoin intersects economics, computer science, systems engineering, physics, and mathematics, tending to involve specialised subcategories that are outside the scope of a general education (like Austrian Economics, Distributed Networking, Thermodynamics, and Cryptology). Unfortunately, despite its clear success, understanding Bitcoin’s characteristics and potential requires extensive study.

And beyond conceptual grounds, its learning curve continues for actual users who must grapple with unconventional methods of managing and transacting their assets. This means learning key management, open-source tooling, transaction tracing, and navigating Bitcoin’s fee market. Even then, users can grow frustrated with periods of high fees or longer wait times, pushing them to either further study Bitcoin scaling tech, abandon it altogether, or become disillusioned.

The implication of this knowledge gap is that Bitcoin is not yet widely trusted. Ironically, as it was designed to minimise trust, we see that bitcoin often requires its new users to place trust in unfamiliar models or companies. These models, essentially a combination of applied mathematics and economic incentives, although they exist elsewhere and are proving to be reliable, are time-consuming to understand. Moreover, most bitcoin companies have little to no brand recognition or customer history. While its existence is widely acknowledged, Bitcoin’s true level of consumer understanding is not yet on equal footing with other systems for fair evaluation.

Conversely, The World’s Reserve Currency is Highly Trusted, yet Not Globally Accessible

Alternatively, there is a high level of trust and comfort with US Dollars. The US Dollar is familiar as the world’s dominant currency and has a reputation of stability. Despite reducing in purchasing power year over year, US Dollars have for the most part either retained their value or outperformed relative to other government currencies.

Source: HedgEye

As a result, there is a high motivation on the part of both consumers and businesses to access dollars globally. This is especially true in Emerging and Frontier markets, where high inflation has become more common and financial markets are less accessible or developed. The need for these populations to preserve savings is high, but solutions for achieving that are often few.

Unfortunately, access to US Dollars is often limited or completely unavailable in such places. KYC/AML laws make it nearly impossible to obtain an offshore US bank account for common citizens, and in countries where US Dollars are available at local banks, capital controls and other forms of government regulation enforce strict limits on the amount that can be owned.

Stablecoins are an Enhanced and Readily Available Version of US Dollars

This brings us to stablecoins.

Coincidentally, maintaining a reliable connection to the US banking system has also been troublesome for the crypto industry. This was notoriously true of Bitfinex, whose former experience with failed wire transfers, delayed withdrawals, and outright account termination aided early growth of the first successful crypto dollar, tether (USDT). With tether, crypto companies and natives no longer had to navigate the complications of exiting to the fiat system when seeking the stability of US Dollars. Intermediating institutions were now servicing US Dollars within crypto systems themselves.

Although issued on crypto rails, stablecoins are solely designed to mimic the price of an existing asset held elsewhere. Therefore a “crypto dollar”, as the name suggests, is essentially just the US Dollar published in a crypto-native format. They tend to function as a type of bank note; created with bank deposits, redeemed with bank reserves, and backstopped because of centralised assets held at the bank.

Importantly, crypto dollars inherit the many property advantages that come with using public settlement networks and personal wallet software: global access, individual custody, and 24/7 direct transfers. Nowadays, they’ve also grown to widespread availability on global exchanges, oftentimes being the most common trading pair with both fiat and crypto assets.

Without either the KYC/AML restrictions when downloading a crypto wallet or the direct enforcement lines from local banks, crypto dollars have effectively broadened the access of US Dollars to global populations. Anyone with an internet connection and mobile phone can now hold US Dollar exposure.

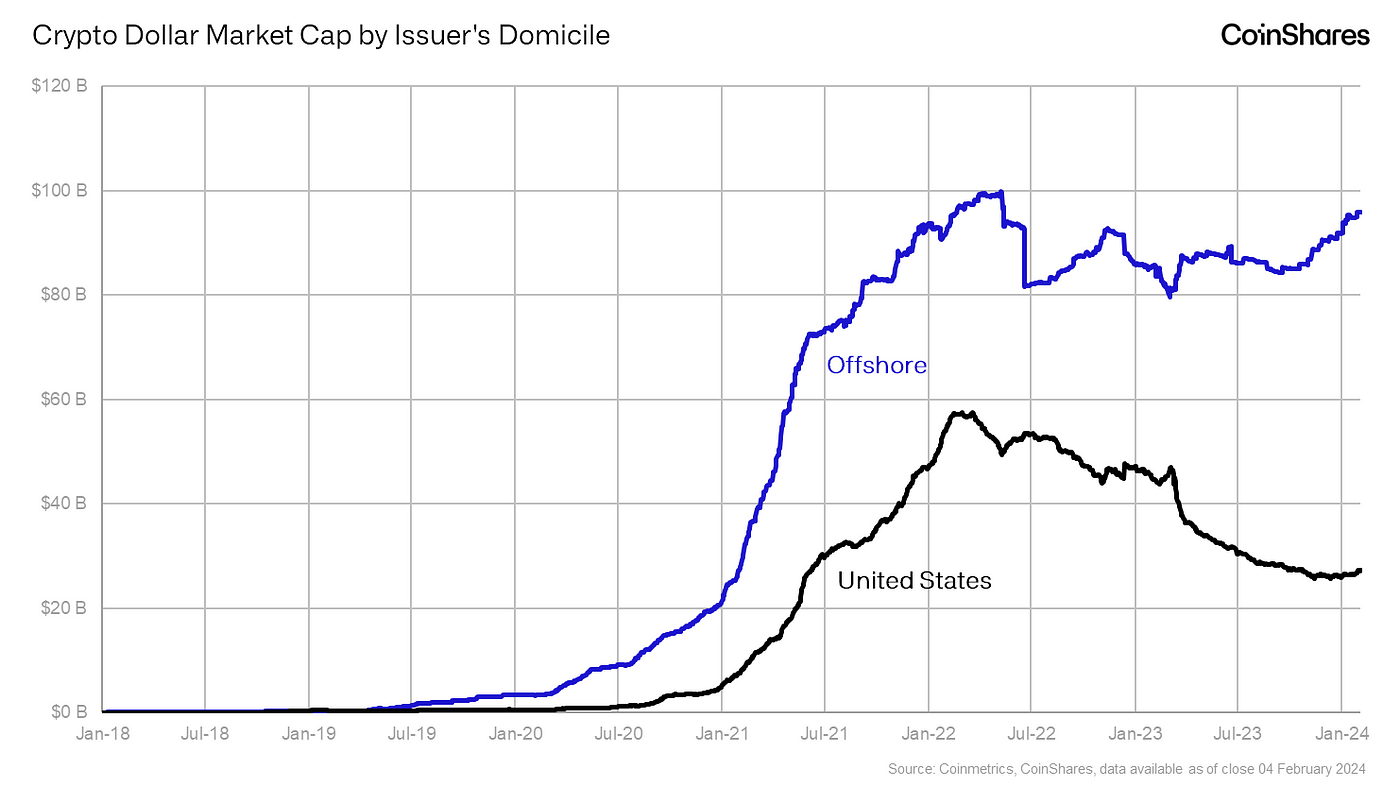

Unsurprisingly, crypto dollar activity has become highly popular outside the US and other developed countries. A larger share of the crypto dollar market is issued by offshore companies; spot trading volumes tend to be higher for such crypto dollars; And, in terms of frequency and value, the largest volume of crypto dollar settlement is on Tron, a crypto network known to have higher usage outside the US.

Bitcoin’s Learning Curve is Smaller for Stablecoin Users

At this point you may be wondering why crypto dollars have not suffered from the same challenges that we find are limiting bitcoin adoption. Of course, they similarly involve unfamiliar tooling, methods of access and transacting. If they too have a learning curve, why is it not halting adoption? or why is such a curve not as significant as bitcoin’s?

We suspect an important distinction is that the case for holding crypto dollars is already widely accepted — it is fully predicated on the underlying US Dollar. While such practical tools may make stablecoins more challenging to use, its value and potential is common knowledge.

In our view, preserving wealth with US Dollars is likely the motivational force for many now entering the crypto ecosystem via stablecoins. This is quite different from the past, when speculators already inside the crypto market tended to acquire stablecoins as a way to de-risk their positions. Thus, we actually view the stablecoin-to-bitcoin adoption gateway as a two-way passage, where the direction of users is now, and possibly will continue, reversing course.

Nevertheless, when it comes to stablecoins, “crypto” is only the means to access the familiar value of US Dollars. While leveraging crypto infrastructure requires its own learning curve, it is only a portion of bitcoin’s overall conceptual hurdle, and the rise in stablecoin ownership clearly shows that users are motivated enough to overcome the relatively lower levels of trust and knowledge required.

Although the stablecoin experience does not teach the investment case of bitcoin, the experience of interacting with companies in the industry, public networks and open-source software certainly helps bridge some of bitcoin’s knowledge and user experience gap.

We therefore believe stablecoin users have less of a climb to conquer Bitcoin’s learning curve, and once on a level playing field, bitcoin has a better chance to compete in the free market of money.

Stay tuned for Part Two!

All Comments