Solana (SOL) generated tremendous hype in 2021, with fans touting its ability to solve the Ethereum (ETH) blockchain's core problem. Solana, it was promised, would be a cheaper and faster place to handle transactions, a better springboard for decentralized finance, or DeFi, and other activities powered by smart contracts.

Then came 2022 and all that pain. Things looked bleak for Solana (and, let's be honest, most of crypto). It didn't help that Sam Bankman-Fried was closely linked to Solana and its SOL token, which sank below $10.

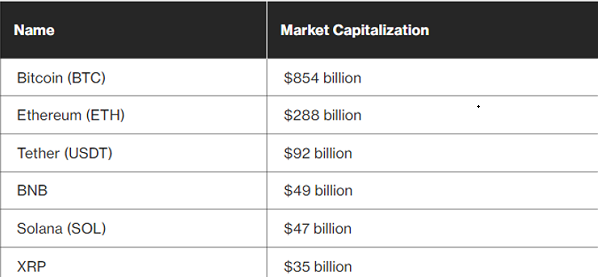

SOL was back in the $20s in October as SBF was on trial. Then, all of a sudden, Solana and SOL turned into just about the hottest things going. SOL is above $100 now for the first time since early 2022 and, at $47 billion, it's the fifth-biggest crypto – and it was briefly fourth-biggest earlier this week.

My colleague Danny Nelson cogently summed up recent events this weekend when SOL exceeded $100:

Saturday's price action capped weeks of frenzied trading that have – at least temporarily – vaulted the Solana blockchain up the leaderboard for on-chain activity. Solana-based decentralized exchanges are nearing Uniswap's multibillion-dollar trading volumes for the first time, according to DefiLlama. Much of that energy is being driven by rampant speculation.

Some of the most popular crypto assets being traded on Solana right now are dog-themed meme coins. But airdrops, too, are prompting droves of traders to test out Solana-based lenders, bridges and other infrastructure.

Ethereum remains the leader among layer-1 blockchains that can run smart contracts, aka the bedrock of DeFi. Ethereum has $29 billion of total value locked, a measure of money stashed in a particular blockchain's ecosystem, far exceeding Solana's $1.5 billion, according to DefiLlama data.

But recent events show Solana may be a serious competitor now.

Here's what else is on my mind in this holiday-shortened week:

A LONG DECADE: The failure amid a hack of Mt. Gox a decade ago was a milestone for the industry, an early sign crypto would need better infrastructure to thrive or, at least, survive. Some 850,000 bitcoins were stolen in that incident, a hoard now worth about $36 billion. All these years later, it appears former customers are starting to get repaid. From CoinDesk's coverage: "The repayment could have some impact on bitcoin prices, due to the sheer volume of the tokens being released, but would not destablize the market, UBS had said in a report earlier this year."

All Comments