From cointelegraph by Nancy Lubale

Bitcoin price has declined by more than 6% over the last 24 hours after rallying to anall-time high of over $109,000a week ago.

Data from Cointelegraph Markets Pro andCoinbase shows that the BTC price fell from a high of $105,424 on Jan. 26, dropping as much as 7.3% to reach an intraday low of $97,750 on Jan. 27.

Bitcoin’s price drop coincides with a drawdown in the broader crypto market triggered by the release of DeepSeek R1, which has shaken the AI sector and negatively affected the prices of AI-themed tokens.

This has left market participants wondering how low BTC prices can go over the next few days.

Could Bitcoin price drop to $70,000?

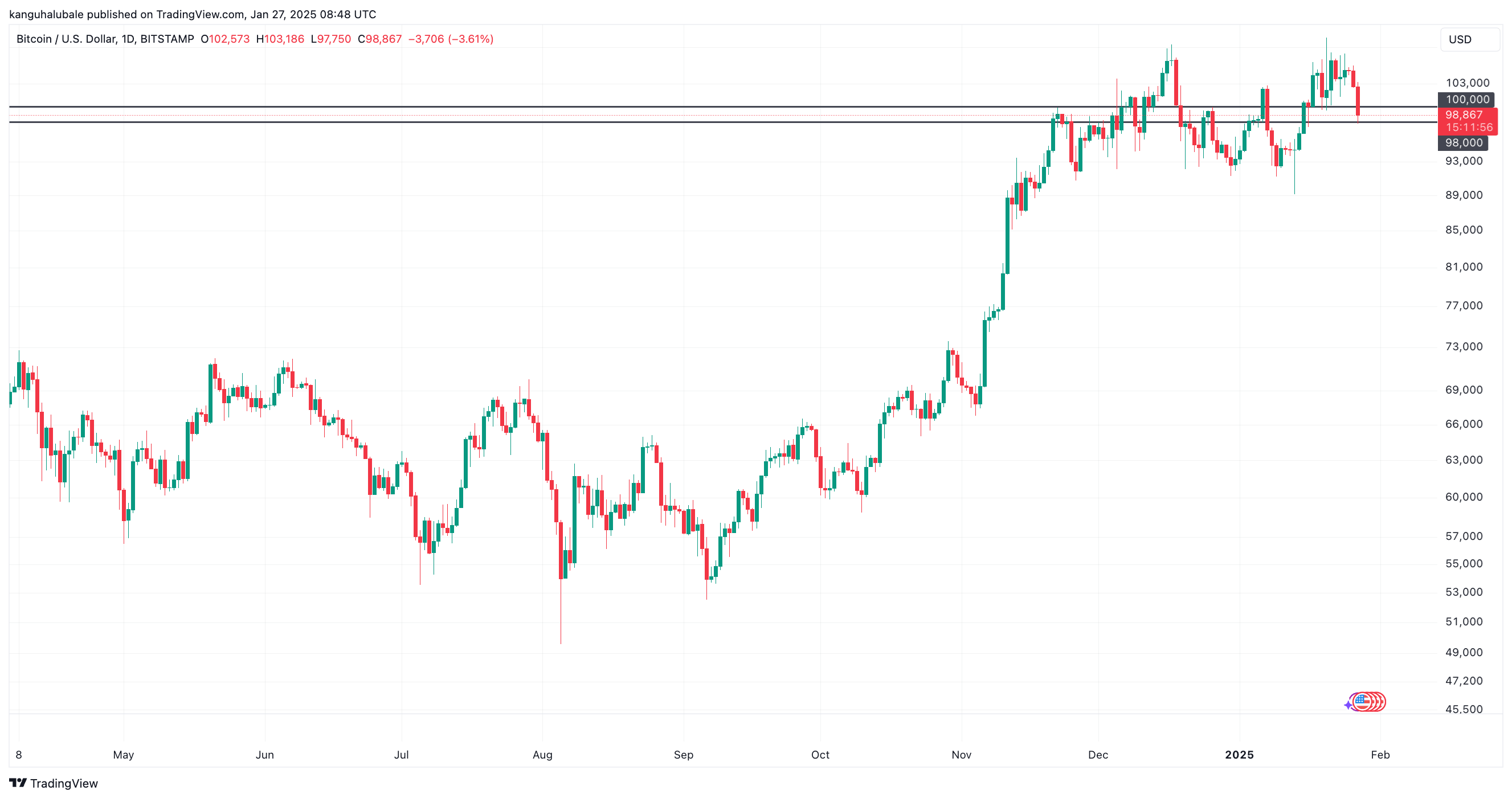

After a failed attempt to hold above $100,000 on Jan. 27, the BTC has retraced toward the $98,000 demand zone.

“Bitcoin price approaches the $100,000 level and is looking weak!” said Bitcoin analyst AlphaBTC in a Jan. 27 post on X.

“$BTC and TradFi futures have been selling off all night, looking really weak as we start a fresh week.”

The accompanying chart below reveals that if bulls reclaim $100,000, the price could rebound from the current levels.

On the contrary, AlphaBTC said that the support at $100,000 was weakening, and the breakdown of this level could cause Bitcoin's price to go below $90,000.

“The 100K level looks like it’s going to get run this time, but the question will be if #BTC can reclaim it with a strong reaction, or will we revisit sub 90K once again?”

BitMEX co-founder Arthur Hayes predicts that Bitcoin could potentially pull back toward the $70,000 to $75,000 range, a move that may trigger a “mini financial crisis.”

According to Hayes, this could lead to a “resumption of money printing” that will send BTC price to $250,000 by the end of the year.

Founder of MN Capital Michael van de Poppe asked his 767,000 X followers not to panic, arguing that the ongoing sell-off is nothing more than just a “short-term shock and panic reaction on the markets.”

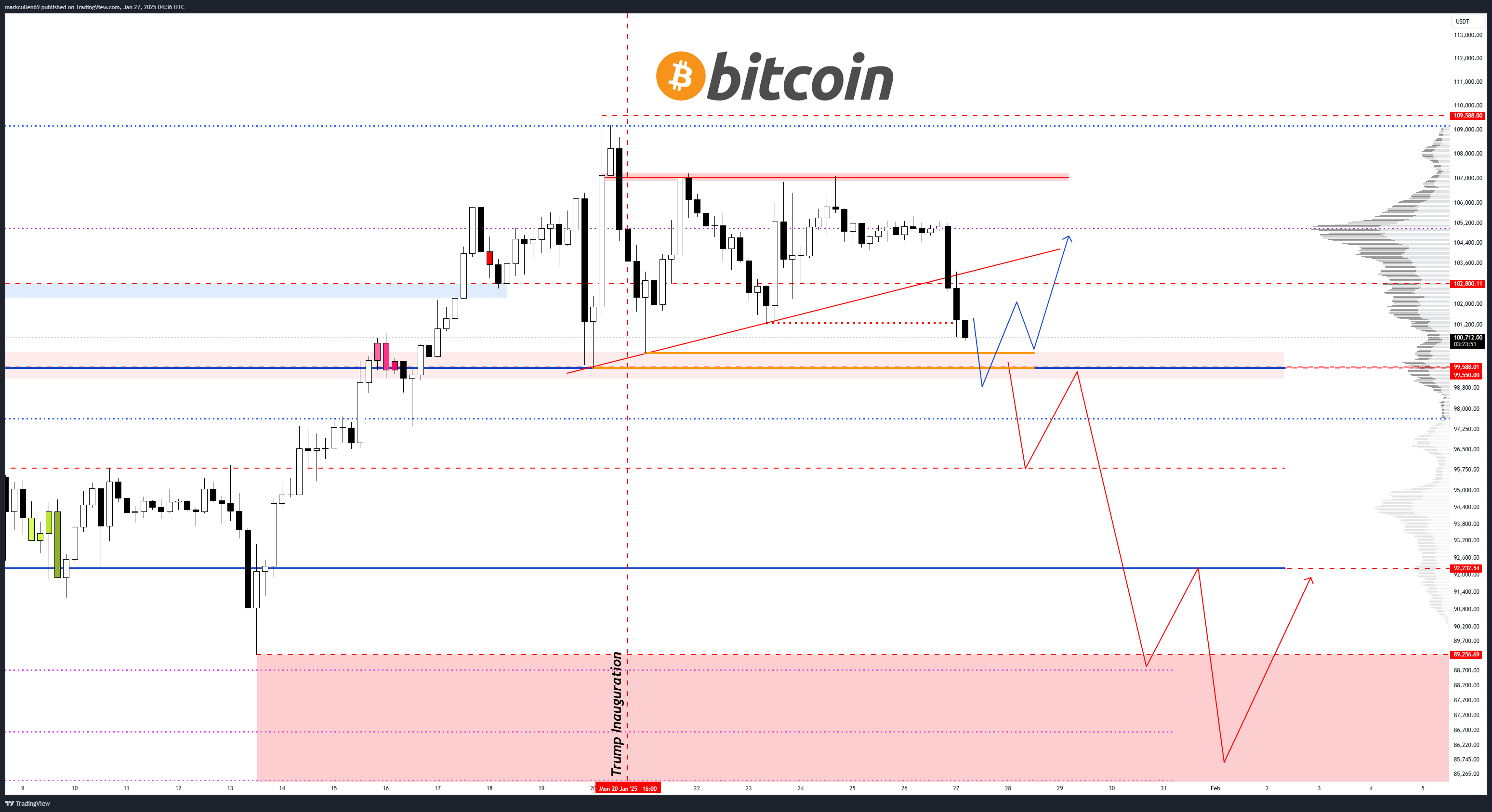

According to van de Poppe, the area between $99,000 and $98,000 is an “exciting entry zone” for Bitcoin investors.

He warned that if demand-side pressure doesn’t mount up from the said level, the price could dip into the lower end of the $89,500 to $91,500 range.

Related: Bitcoin falls below $100K for the first time under Trump presidency

50-day EMA is a test for Bitcoin

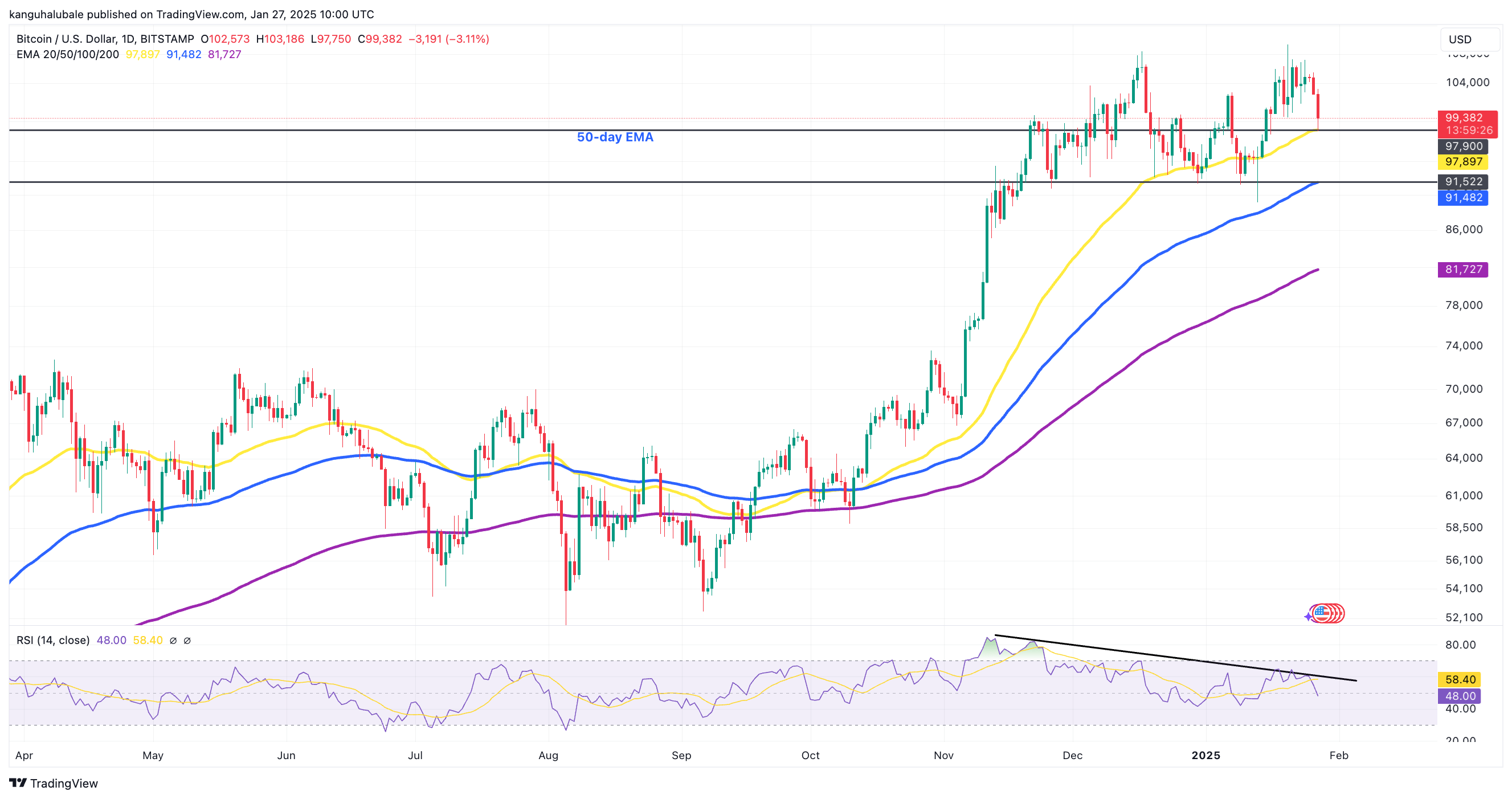

From a technical point of view, Bitcoin’s price is trading above the $97,900 support level, embraced by the 50-day exponential moving average (EMA).

Losing this support could cause the BTC price to collect demand-side liquidity down toward the 100-day EMA, currently at $91,482.

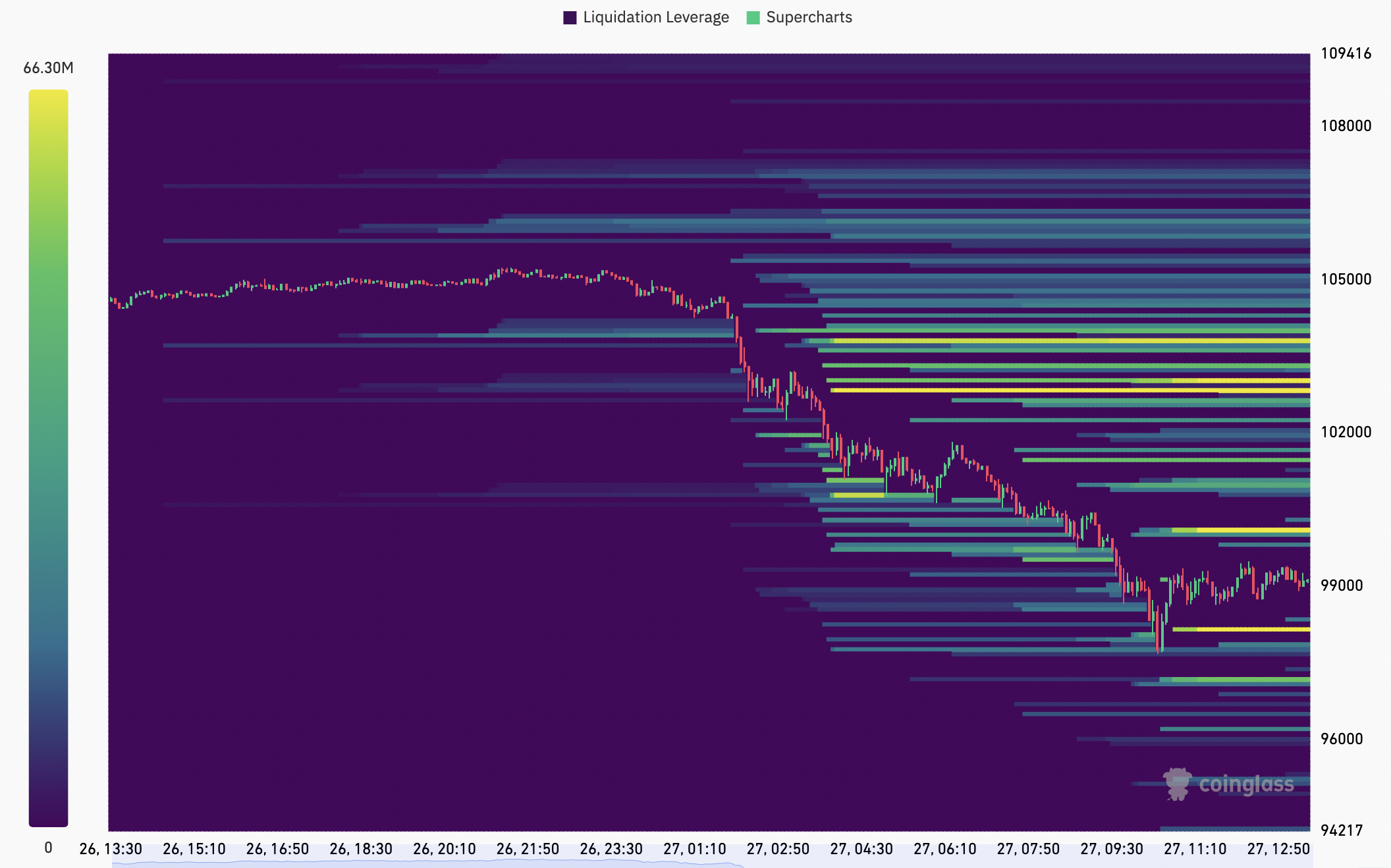

The importance of the 50-day EMA was reinforced by significant liquidity building up just above the $98,000 support level, as shown by data from CoinGlass.

In other words, the 50-day EMA at $96,900 has a good chance of becoming the new local low for Bitcoin before the next leg up. On the other hand, breaking below $ 90,000 could present real trouble for the bulls in Q1.

All Comments