Soaring venture capital interest in Bitcoin layer-2 projects has brought into sharp focus whether the new scaling solutions truly deserve the classification.

Research from Spartan Group in December attributed the majority of Bitcoin layer-2 transactions to Stacks, Lightning, RSK and Liquid.

Bitcoin scaling has grown far beyond those four projects now, with 73 Bitcoin scaling solutions being developed with a combined total value locked of $3.61 billion as of June 7, according to BTCL2 data.

But despite the plethora of Bitcoin layer 2s and influencers pronouncing “Bitcoin L2s” as the hot new narrative, the label is contentious.

That’s because the structure of most self-proclaimed Bitcoin layer 2s is more similar to a sidechain, which is a blockchain that runs parallel to the native chain and doesn’t inherit its security. True L2s arguably should run on top of the native chain and inherit its security.

Bai Yu, head of CKB Ecosystem Fund — an investor in Bitcoin scalability and interoperability projects — argues that the term “L2” for sidechains is simply a marketing tactic.

“A true L2 should operate on top of the base layer, inheriting its security, while a sidechain is a separate blockchain with its own security model,” Yu says.

Using the term L2 for sidechains can indeed be misleading and may be driven by marketing considerations rather than technical accuracy.”

And according to Mikko Ohtamaa, co-founder of algorithmic investment protocol Trading Strategy, the true test of a genuine L2 is: “Can you get your money back without someone else’s permission?”

Bridges and native assets

Sidechains do not automatically support the parent chain’s native asset. Instead, Bitcoin (or whatever native asset it may be) is transferred through pegging mechanisms that lock assets in their origin and are represented by equivalent value tokens in the sidechain.

Ethereum scaler Optimism, widely considered a true layer 2, also requires native ETH to be locked up on the native chain. The difference is that Optimism is a rollup, which means transaction data is periodically committed back to Ethereum, and its security is anchored to the main chain.

For pegged sidechain assets, security relies on the rules of the new chain and could be compromised during an attack.

There is no official consensus on the definition of a true L2 for Bitcoin, but Ethereum has an archive of arguments to reference, thanks to the lengthy debates on whether Polygon’s PoS should be allowed in the layer-2 club.

The Ethereum community defines layer 2 as: “a separate blockchain that extends Ethereum and inherits the security guarantees of Ethereum.”

Does it matter if they are “real” Bitcoin L2s or not?

So, most of the 73 Bitcoin layer-2 projects listed on BTCL2 don’t fit into the standards of what is generally considered a layer 2. Does it matter?

“Degens don’t care; they just want to make money,” Bob Bodily, founder and CEO of Ordinals marketplace Bioniq, tells Magazine.

“But many in the space care a lot and are working toward standards [and] definitions to make it more clear,” he adds.

David Schwed, chief operating officer of blockchain security firm Halborn, tells Magazine that there is “no consensus on the true technical requirements” for a protocol to be considered a layer 2, other than solutions that address scalability issues for first layers.

“Personally, I think the distinction is less important as most users of these layer 2s may not truly understand the technical nuances between these terms.”

The intricacies of what goes on in the background may not be important for many end-users, whose main purpose may simply be to send and receive Bitcoin faster.

But that perception could change if the security of their funds is threatened by new vulnerabilities of fledgling scaling solutions that don’t exist on the native Bitcoin chain, which is widely believed to be the securest, most decentralized and bomb-proof blockchain of them all.

“These networks can introduce additional points of vulnerability and potential centralization not present in the main chain,” Schwed says.

Schwed also notes that sidechains often use oracles or cross-chain communication tools to maintain consistency with the assets on the main blockchain.

Oracles are systems used to feed data from outside sources into a blockchain. These tools add a layer of complexity and bring their own risks.

For instance, if an oracle is compromised or if there is a flaw in the communication protocol, it could lead to incorrect data being used, affecting transactions and the integrity of the assets on the sidechain.

This makes the entire system more vulnerable to attacks or errors that could lead to financial loss for users.

Sidechains don’t have native Bitcoin

Spartan Group researchers say that the launch of Ordinals non-fungible tokens on Bitcoin ushered in the age of “building on Bitcoin” and sparked a development revolution in infrastructure and scaling layers for Bitcoin.

“The majority of Bitcoin layer-2 solutions utilize some form of [multisignature] cross-chain bridge to facilitate the conversion of Bitcoin between the [native chain] and L2,” Cipher Wang, CEO and co-founder of Bitcoin layer-2 project UTXO Stack, tells Magazine.

A multisignature wallet structure, or multisig, is when a group of entities controls the process of locking and unlocking assets between chains, adding a layer of oversight, which comes as a package deal with another layer of trust and permissions.

“Withdrawal requests from users are not entirely permissionless and require confirmation from nodes,” Wang says.

But the multisig structure isn’t what eliminates the projects from being a true layer 2, as bridges between those on Ethereum, like Optimism, are also controlled by multisigs. The difference comes down to whether these assets are secured by Bitcoin’s security.

Another critical point is the verifiability of assets on transactions, according to Punk3700, the pseudonymous developer behind Bitcoin scaling project BVM.

“On Ethereum, you can verify it with a smart contract. On Bitcoin, there is no smart contract,” Punk3700 tells Magazine.

“So, it’s sort of like, ‘Trust me, bros.’”

Through the multisig structure, users can access an asset that maintains equal value to the native Bitcoin in the second layer while accessing the second layer’s smart contract for myriad purposes, such as accessing DeFi services — though DeFi in Bitcoin is still considered to be in its infancy compared to Ethereum or Solana.

Sidechains don’t necessarily use the mother chain’s native token (or even its pegged equivalent) to pay fees for transactions. However, popular Ethereum layer 2s like Arbitrum and Optimism use bridged Ether that is recorded on and secured by the main chain.

L2s ensure you get funds back — sidechains don’t

These Ethereum scalers are rollups, which means that transactions occur outside the Ethereum blockchain but are recorded there later. Since the data is stored on Ethereum, users still have the chance to withdraw their Ether from the main chain even if the second layer encounters issues.

This isn’t the case for Bitcoin, as its scripting language, Script, limits the network’s ability to support advanced smart contracts and operations like rollups.

Developers have found methods to bypass this limitation, such as soft forks, to activate sophisticated applications and even access Simplicity, a more flexible programming language.

A popular solution to scale the network and enhance smart contract capabilities has been to launch sidechains, which are brand new blockchains with their own features, consensus mechanisms and often their own native tokens for transaction fees.

If a sidechain shuts down for whatever reason, there’s a possibility that the user will not be able to withdraw their assets on the first layer, though those who control the multisig wallets may be able to assist in recovery.

Edan Yago, head of strategy at the Bitcoin DeFi platform Sovryn, argues that as funds in most Bitcoin layer-2 projects are not secured by Bitcoin’s proof-of-work network, they are thereby disqualified from being considered true layer 2s.

Lightning is an L2, and ZK-rollups could happen in future

There are exceptions, with the most famous example being the Lightning Network, a Bitcoin layer 2 that uses a system of channels to enable offchain transactions. Opening and closing of these channels requires onchain transactions, which are broadcast to the Bitcoin network and confirmed by proof-of-work.

There has also been rising support for reenabling “OP_CAT,” an operation code that would enhance Bitcoin’s scripting capabilities. This was removed by Bitcoin creator Satoshi Nakamoto in 2010 due to security concerns.

StarkWare, an Israel-based developer behind Ethereum layer 2 Starknet, recently announced a $1-million research fund for using OP_CAT and zero-knowledge (ZK) proof technology to help scale Bitcoin.

For now, Bitcoin natively cannot use ZK scalers like ZK-rollups due to scripting limitations, but some projects rely on a light client to do so.

“We’re using ZK light clients now for verification, but in the future, we can easily replace ZK light clients with OP_CAT or BitVM when they’re ready,” Punk3700 says, adding that such developments may be a year away.

Ordinals and Runes highlight the need for scaling

Following the Ordinals launch last year, the launch of the fungible token protocol Runes in April supercharged demand for Bitcoin scaling infrastructure due to a surge in transactions.

The seven-day average for Bitcoin transactions soared to an all-time peak on May 20, according to IntoTheBlock data.

According to GeniiData, a Bitcoin data platform, Runes dominated over 61% of Bitcoin’s transactions on June 6, while Ordinals took up about 8.5% of its own. That leaves just about 30% of transactions for transfers and other miscellaneous requests.

The obvious demand for scaling has seen VCs chase after “L2s” waving fistfuls of money.

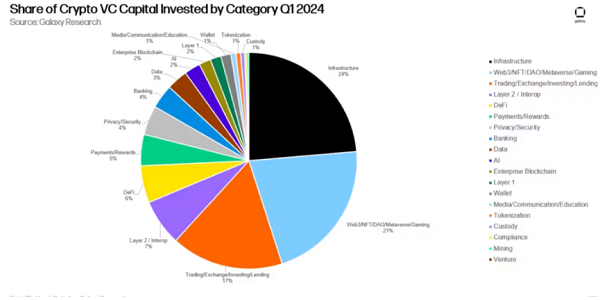

In the first quarter, VCs invested $2.49 billion into crypto firms, according to Galaxy Digital. Layer-2 projects were the fourth-most popular investment category, accounting for 7% of that total.

Alex Thorn, head of research at Galaxy Digital, tells Magazine that the company tracked 13 fundraising rounds by Bitcoin layer-2 projects. Of those, eight did not disclose funding amounts, while the remaining five raised at least $34.7 million together. While that is just a small portion of the total reported by Galaxy Digital, Thorn notes that Galaxy’s reported value solely relies on publicly available data and that the actual amount could be much higher.

“We expect the actual amount raised by Bitcoin L2s was significantly higher, potentially above $100 million,” says Thorn.

“We independently know of several deals that either haven’t been reported at all or which were publicly announced, but funding amounts were not disclosed, so the $34.7 million is a lower bound,” Thorn says.

Lightning Network set the standard for L2s

Yago of Sovryn calls Lightning Network a “genuine” layer 2, while Ohtamaa says it’s “the most robust Bitcoin innovation in the last decade.”

Though it’s one of the oldest and most widely supported Bitcoin layer-2 projects, it has faced adoption challenges. Its $320 million in total value locked has been surpassed by newer Bitcoin sidechains like Merlin Chain and BounceBit, according to BTCL2.

Sidechains can also potentially host more complex smart contracts and decentralized applications.

But Ohtamaa argues that such protocols do not have any connections to Bitcoin, its native asset or security.

“By this argument, we already have the best Bitcoin sidechain in the world and it is called Ethereum,” Ohtamaa says.

“If you want to use Bitcoin DeFi, just use your (wrapped) Bitcoin on Ethereum, and it will be better than any other sidechain.”

All Comments