From financemagnates by Louis Parks

Bitcoin has reached unprecedented levels, but what's next?

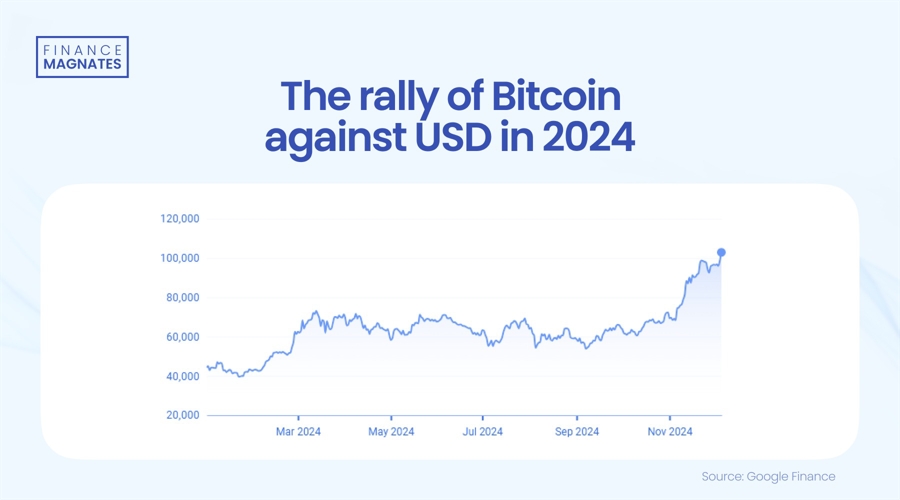

Bitcoin has done it. After years of dizzying highs, crushing lows, and endless debates, the world’s leading cryptocurrency has crossed the $100,000 mark.

It’s a monumental achievement for a digital asset once dismissed as a passing trend, but now the big question looms: where does Bitcoin go from here, where does FinTech go from here? Whether you’re an investor, a skeptic, or a curious onlooker, there’s no denying that Bitcoin’s next chapter promises to be just as intriguing as the last.

Bitcoin and FinTech—The Future Looks Bright

According to Petr Kozyakov, co-founder and CEO of Mercuryo, a London-based leading payment infrastructure platform in the digital token space, “Cryptocurrency is destined to reach mass adoption in just the same way as the World Wide Web has today,” he said.

“Bitcoin has entered a new phase of adoption and recognition as a store of value and a transformative asset class,” said Matt Mena, a crypto research strategist at 21Shares. “Bitcoin will maintain its momentum leading into Q1 of 2025, well above the $100K mark,” he went on to say.

$BTC “is emerging as the world’s reserve capital network,” MicroStrategy executive chairman @saylor says, adding: “People are realizing that bitcoin is better than real estate. It’s better than stocks.” pic.twitter.com/i05CXmaMvq

— Yahoo Finance (@YahooFinance)December 5, 2024

“People are realizing that bitcoin is better than real estate. It’s better than stocks,” said Michael Saylor of MicroStrategy.

Institutional Investors: The New Power Players?

With Bitcoin hitting $100,000, institutional investors are stepping in like never before. Hedge funds, wealth managers, and even pension funds are now adding Bitcoin to their portfolios, signaling its evolution from a speculative asset into a financial staple. This institutional embrace lends legitimacy to Bitcoin and could drive its adoption further into the mainstream.

🔊 Bitcoin has catapulted over $100,000 for the first time in a major milestone for the cryptocurrency. Find out more on the Reuters World News podcast https://t.co/CDLSD3V0nW pic.twitter.com/mGH3cIO2Gd

— Reuters (@Reuters)December 5, 2024

However, increased institutional involvement also raises concerns about market manipulation and over-regulation. As traditional finance tightens its grip on crypto, the freewheeling, decentralized ethos that defined Bitcoin’s early days might give way to a more corporate, rule-heavy environment.

Tech Challenges: Scaling for the Future

Bitcoin’s rise has brought its technical limitations into sharp focus. As transaction volumes skyrocket, Bitcoin’s network faces significant scalability issues, with high fees and slow processing times threatening to undermine its usability. Enter the Lightning Network, a second-layer solution designed to make Bitcoin transactions faster and cheaper.

🌩️ The #LightningNetwork is among the most widely adopted real-world crypto payment systems, powering fast, low-cost transactions at 8,000+ merchants globally.Lightning is indispensable as we reshape money movement with PayFi. 🧵 pic.twitter.com/ltGe3qZeHx

— Astra (@Astralabs_LN)December 4, 2024

While promising, these upgrades come with challenges. Some critics argue that Bitcoin’s design is too outdated to compete with newer, faster blockchain technologies like Ethereum and Solana. Others believe Bitcoin doesn’t need to evolve—it just needs to maintain its status as a store of value. The next few years will be critical in determining whether Bitcoin can grow into its role as both a digital asset and a functional currency.

Retail Investors: Hold, Sell, or Double Down?

For retail investors, Bitcoin’s $100,000 milestone is a moment of celebration—and tough decisions. Some early adopters are cashing out, reaping life-changing gains. Others are holding on, convinced that Bitcoin’s journey to $1 million is inevitable. And then there are the new investors, lured by the milestone, who are diving in with dreams of striking it rich.

But history offers a cautionary tale. Bitcoin’s past is littered with dramatic crashes, and the higher the climb, the harder the fall. Retail investors must navigate a volatile market where emotions often overpower logic. For those in the game, tools like crypto wallets and investment platforms are becoming increasingly crucial in managing risk and seizing opportunities.

The Regulatory Landscape: Boom or Bust?

Bitcoin’s rise to $100,000 has caught the attention of regulators worldwide. Governments that once ignored or ridiculed crypto are now scrambling to develop policies to manage its influence. Taxation, anti-money laundering measures, and even outright bans are on the table, depending on the country.

For Bitcoin, the regulatory environment is both a challenge and an opportunity. Clearer rules could encourage more widespread adoption, particularly among institutional investors. But heavy-handed regulation could stifle innovation and limit Bitcoin’s potential to disrupt traditional finance.

The Road Ahead

Bitcoin’s $100,000 milestone isn’t just a number, it’s a statement. It signals the cryptocurrency’s transformation from a niche experiment to a major player in global finance. But, to misquote Stan Lee, with great power comes great uncertainty. Will Bitcoin stabilize as a trusted asset, or will its volatility continue to spark wild market swings? Will new technologies make it more accessible, or will competition from other blockchains erode its dominance?

For now, Bitcoin’s future is a mix of potential and unpredictability amid the FinTech universe. What’s certain is that its journey—from $0 to $100,000 and beyond—is reshaping the financial world, creating opportunities, challenges, and no shortage of drama along the way.

All Comments