From VeradiVerdict - Issue #288

Key Takeaways:$ Pantera recently invested into Aevo, a decentralized derivatives exchange platform focused on options and perpetual trading. Previous investors include Paradigm, Dragonfly Capital, and Coinbase Ventures.$ Aevo runs on Aevo L2, a custom Ethereum rollup built with the Optimism stack.$ Aevo’s main products offered on the exchange are perpetual futures, options, and pre-launch tokens.IntroductionAevo is a decentralized derivatives exchange platform focused on options and perpetual trading. It runs on Aevo L2, a custom Ethereum rollup built using the Optimism stack. This enables Aevo to support over 5,000 transactions per second and handle over $30 billion in trading volume so far.

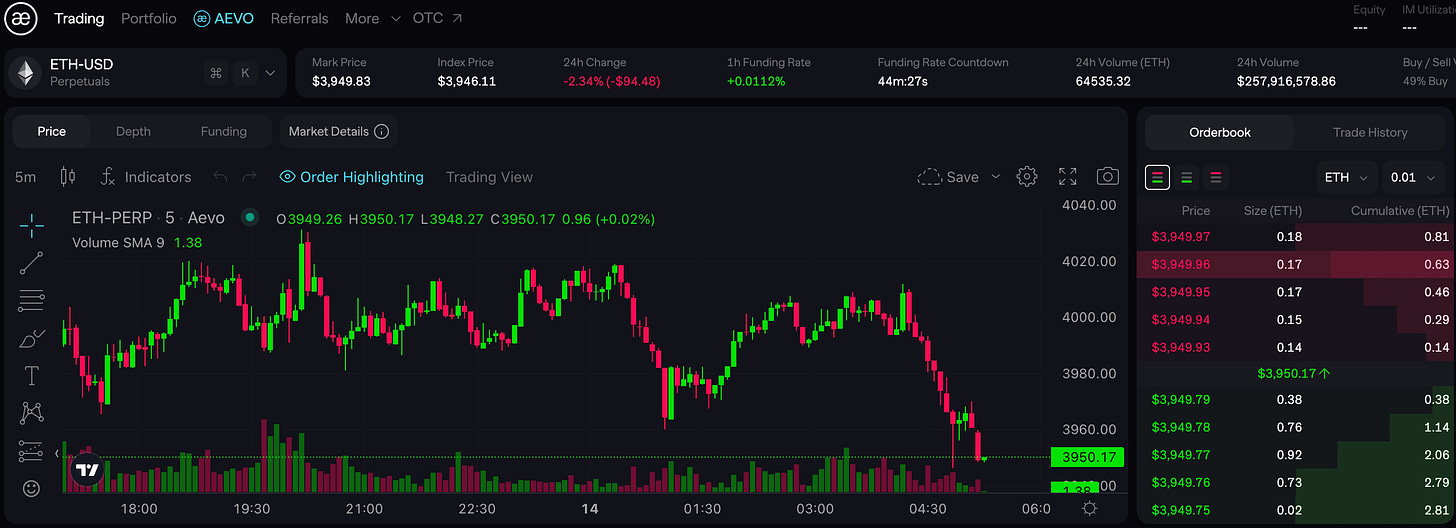

The exchange uses a hybrid model - an off-chain central limit order book for matching trades, combined with on-chain settlement of the actual trades using smart contracts on Ethereum L2. This allows Aevo to provide a high-performance, low-latency trading experience similar to centralized exchanges while maintaining the security and transparency of decentralized settlement.

Aevo offers three main products currently:

- Perpetual Futures - Allows users to long or short crypto assets with up to 20x leverage. Aevo supports a variety of crypto perpetuals including BTC, ETH, SOL, AVAX and more.

- Options - Provides an on-chain options order book where users can buy and sell call/put options on crypto assets with various strike prices and expiries.This includes ETH and BTC options with weekly, biweekly and monthly expiries

- Pre-Launch Token Futures - Aevo offers futures markets for tokens that have not launched yet. Once the token launches on a CEX, the pre-launch future converts into a regular perpetual future.These have special parameters like 50% initial margin, no index price, and no funding payments. Price is fully speculative, based on market demand.Aevo is the go-to place for pre-launch markets now, earning the name the “Coingecko/Coinmarketcap of Pre-Launch tokens”. Recent successful pre-launches include Jupiter and Starknet.

Transition from Ribbon Finance to AevoAevo was created by the same team behind Ribbon Finance, a pioneering DeFi options protocol that has processed over $10 billion in options volume through automated options vaults. Ribbon's options vaults have an all-time high TVL of over $350 million and have earned over $50 million in options premiums for depositors.

In late 2023, the Ribbon team decided to expand from options vaults into a full-fledged decentralized options and perpetuals exchange. This led to the creation and launch of Aevo.

The Ribbon team brought their deep experience and track record in DeFi options to Aevo. The exchange has quickly gained traction, with over $30 billion traded in just a few months since launch. Aevo aims to build on Ribbon's success to create the leading decentralized derivatives exchange.

The team behind the Innovation

Julian Koh and Ken Chan, co-founders of Ribbon Finance, bring a wealth of experience from their tenure at Coinbase and their academic backgrounds. Julian, a Cornell University alum, worked on crypto integrations, custody, and staking at Coinbase, and also contributed to Metastable Capital with research and due diligence. Ken's experience includes significant roles at Coinbase, where he focused on custody, prime brokerage, and asset additions, and a stint as a Research Engineer at Zilliqa, enhancing his blockchain development skills.Their combined expertise and history in the crypto space make them a strong team to build in the DeFi space.ConclusionAevo is a fast-growing decentralized derivatives exchange that has quickly established itself as a major player in the DeFi derivatives space. By combining the performance and user experience of centralized exchanges with the security and transparency of decentralized settlement, Aevo offers a compelling platform for trading crypto derivatives on-chain.The exchange's core products - perpetual futures, options, and pre-launch token futures - have all seen strong adoption, with over $30 billion in total trading volume in less than a year of launching.

Aevo was created by the team behind Ribbon Finance, a pioneering DeFi options protocol that has processed over $10 billion in options volume. The team's deep expertise in DeFi options has informed the design and development of Aevo, which builds on Ribbon's success to create a more comprehensive derivatives exchange.

Looking ahead, Aevo is well-positioned to continue its rapid growth as more users and assets migrate to decentralized trading platforms. With its innovative products, high-performance infrastructure, and experienced team, Aevo aims to become the leading destination for trading crypto derivatives in DeFi.

- Paul Veradittakit

All Comments