Babylon is a leading project in the Bitcoin ecosystem and the largest Staking infrastructure for Bitcoin, unlocking the revenue potential of 21 million Bitcoins. It aims to extend the security of Bitcoin to protect a more decentralized POS world.

1. Unlocking Bitcoin’s Staking and Security Value

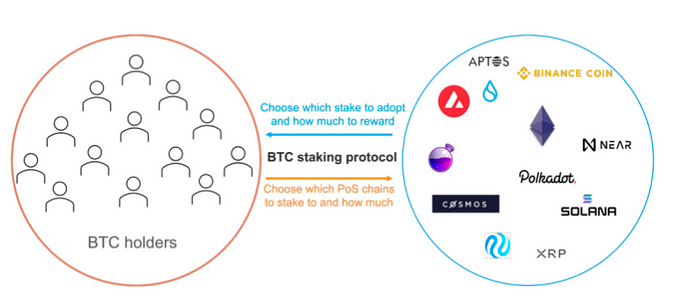

Despite Bitcoin’s current market value exceeding $700 billion, its value has long been untapped due to challenges such as the lack of smart contracts and difficulty in scaling. Babylon introduces an innovative approach to extend Bitcoin by extracting security from the Bitcoin chain and sharing it with various Proof-of-Stake (PoS) chains like Cosmos, Binance Smart Chain, Polkadot, Polygon, etc., providing Staking returns for BTC Stakers while ensuring the security of the PoS chains.

Babylon envisions extending Bitcoin’s security to safeguard the decentralized world. By leveraging three aspects of Bitcoin — its timestamp service, block space, and asset value — Babylon can transfer the security of Bitcoin to numerous PoS chains, creating a more robust and unified ecosystem.

Babylon’s Bitcoin staking protocol utilizes a remote staking method, overcoming the absence of smart contracts through cryptographic innovations and optimization of Bitcoin script language. This allows Bitcoin holders to stake their assets in a trustworthy manner without the need to bridge to PoS chains, providing complete and slashable security guarantees. Babylon’s innovative protocol eliminates the need for bridging, encapsulating,and custodianship of already staked Bitcoins.

A key aspect of Babylon is its BTC Timestamp Protocol. This protocol timestamps events from other blockchains onto the Bitcoin network, allowing these events to benefit from Bitcoin’s timestamp, similar to Bitcoin transactions. This effectively leverages the security of Bitcoin as a timestamp server. The BTC Timestamp Protocol achieves rapid disengagement of stakes, composable trust, and reduced security costs, maximizing liquidity for Bitcoin holders. The protocol is designed as modular plugins, adaptable to various PoS consensus algorithms, and forms the foundation for constructing reset protocols.

2. Babylon’s Trustless Staking Mechanism

Babylon achieves secure staking without requiring Bitcoin to be moved from the user’s address. Bitcoin holders can keep their assets in their self-custodied vaults, with funds exiting the vault only in two scenarios:

1. Unlocking: Stakers can retrieve their staked funds using their private keys.

2. Default: In case of a protocol violation by the staker, funds are automatically liquidated from the vault.

Both scenarios involve no third parties, and there is no other way for funds to exit the vault.

Babylon’s design aims for a trustless staking and slashing mechanism. Firstly, Babylon’s staking mechanism locks Bitcoin on the Bitcoin chain (referred to as “Staking Address”) rather than transferring it to a PoS chain. Bitcoin at this address is considered collateral during verification on the PoS chain, ensuring the honesty of validators. If validators violate rules, their collateral is slashed. This means Bitcoin holders can earn PoS chain rewards without exposing their assets to the PoS chain.

Moreover, Babylon’s Slash mechanism is implemented through the use of advanced cryptography, innovative consensus protocols, and optimized Bitcoin script language. Specifically, Babylon employs a technique known as “Accountable Assertions,” which enables the detection of misconduct on the PoS chain. Upon identifying violations, penalties are sent back to the Bitcoin chain, triggering the burning of stake on the Bitcoin chain. This design avoids the risks and complexities associated with involving third parties while maintaining both security and reliability.

Finally, Babylon’s system architecture is based on a three-layer structure, with the Babylon chain as the control plane facilitating interaction between Bitcoin and the data plane (PoS chain). This design enables Babylon to achieve interoperability and network effects between PoS chains and Bitcoin without involving third parties. For example, Babylon can address cross-PoS chain transactions based on the final states of two PoS chains on the Babylon chain.

In summary, Babylon, through advanced cryptography, consensus protocol innovations, and optimized Bitcoin script language, coupled with a three-layer system architecture, achieves a trustless staking and slashing mechanism without involving third parties.

As a result, Babylon can accomplish the following without requiring smart contracts or forking Bitcoin:

- Trustless staking: No bridging or custodianship

- Rapid unbundling of staked Bitcoin, ensuring high liquidity

- Slashing security for PoS chains

In February of this year, Babylon implemented the BTC timestamping testnet (Babylon Testnet Phase One: Reducing the original 21-day staking period to 1 day using BTC timestamping in Cosmos).In July, Babylon implemented the BTC staking proof-of-concept (PoC), with the BTC staking testnet scheduled for Q4. In Q1–2 of 2024, Babylon will launch the Mainnet, followed by the introduction of Data Availability in Q3–4 of 2024.In Q1–2 of 2025, Babylon plans to introduce the BTC Liquidity Marketplace.

3. Expanding Bitcoin’s Application Landscape

The business model can consider both vertical and horizontal expansion:

- Vertical: Empowering the entire BTC ecosystem, such as BTC rollup or BTC middleware, allowing Bitcoin to be used on Layer 2 and in the middle layer

- Horizontal: Staking BTC on different PoS chains to expand BTC’s possibilities, enabling Bitcoin to generate income on various PoS chains.

While expanding Bitcoin’s application landscape, Babylon aims to capture the following values:

- Babylon will collect staker rewards from a portion of stakers.

- Fees collected by Babylon will be distributed to node operators and Babylon’s treasury.

- More stakers will boost the token value of Babylon.

4. Hardcore Research and Technology Team

Babylon originated from a research paper on Bitcoin security, co-authored by co-founders David Tse, Fisher Yu, Sreeram Kannan (founder of EigenLayer), and other collaborators.

- David Tse (Co-founder):Received a Bachelor’s degree in Systems Design Engineering from the University of Waterloo in 1989, a Master’s degree in Electrical Engineering from MIT in 1991, and a Ph.D. in Electrical Engineering from MIT in 1994.His research focus at Stanford University includes information theory and its applications in wireless communication, machine learning, energy, and computational biology. He was awarded the Claude E. Shannon Award in 2017 and elected as a member of the National Academy of Engineering in 2018.

- Mingchao (Fisher) Yu (Founding CTO):Holds a Ph.D. in Telecommunications from The Australian National University, specializing in the development of theory and algorithms in network information theory and coding, with a particular focus on wireless communication.

Additionally, the team includes an advisory board with members such as Sunny Aggarwal (Co-Founder of Osmosis Lab) and Sreeram Kannan (Founder of EigenLayer).

5. Envisioning the Future of Babylon’s Bitcoin Ecosystem

Babylon aims to extend Bitcoin’s security to Bitcoin’s data availability layer and Layer 2.

- Bitcoin Data Availability Protocol: Babylon is developing a Bitcoin Data Availability protocol, utilizing Bitcoin’s limited block space to execute critical tasks, such as providing an anti-censorship layer for PoS chains. Bitcoin’s block space, as the most secure and difficult-to-censor storage space globally, becomes a valuable resource for protecting the decentralized world.

- Babylon Layer 2: Babylon can act as an intermediate layer between Bitcoin rollup and Bitcoin, serving as a temporary store data layer before inscription. This Layer 2 can significantly empower the entire ecosystem:

- Babylon protects the security of Layer 2.

- Substantial reduction in gas fees at Layer 2.

- Layer 2 can generate a plethora of Bitcoin applications.

- Handles the overflow of user traffic from Bitcoin Layer 1, significantly increasing the user base of the Bitcoin ecosystem.

In conclusion, Babylon, as a leading project in the Bitcoin ecosystem, aims to expand a Bitcoin-centric ecological world, unlocking the Staking value of a $700 billion market cap Bitcoin and transforming Bitcoin into a more widely adopted interest-bearing asset, providing income for Bitcoin holders. Simultaneously, Babylon significantly enhances the ecological value of Bitcoin by vertically expanding Bitcoin’s Layer 2 and middle layer applications and horizontally expanding Bitcoin’s income value on various POS chains, nurturing a safer and larger POS economy.

All Comments