From paragraph by TPan

On the note of celebrating special days, it’s holiday season for many of us. That means family, friends, and conversations about various topics, including crypto.

Fortunately, this year the conversations are met with (hopefully) curiosity instead of sarcastic remarks like this one.

The day before Thanksgiving Chris Burniske, respected VC and OG in the space, shared practical tips on how to have conversations with friends and family about crypto.

And that got me thinking about how to explain crypto to people who ask me about it. What IS crypto?

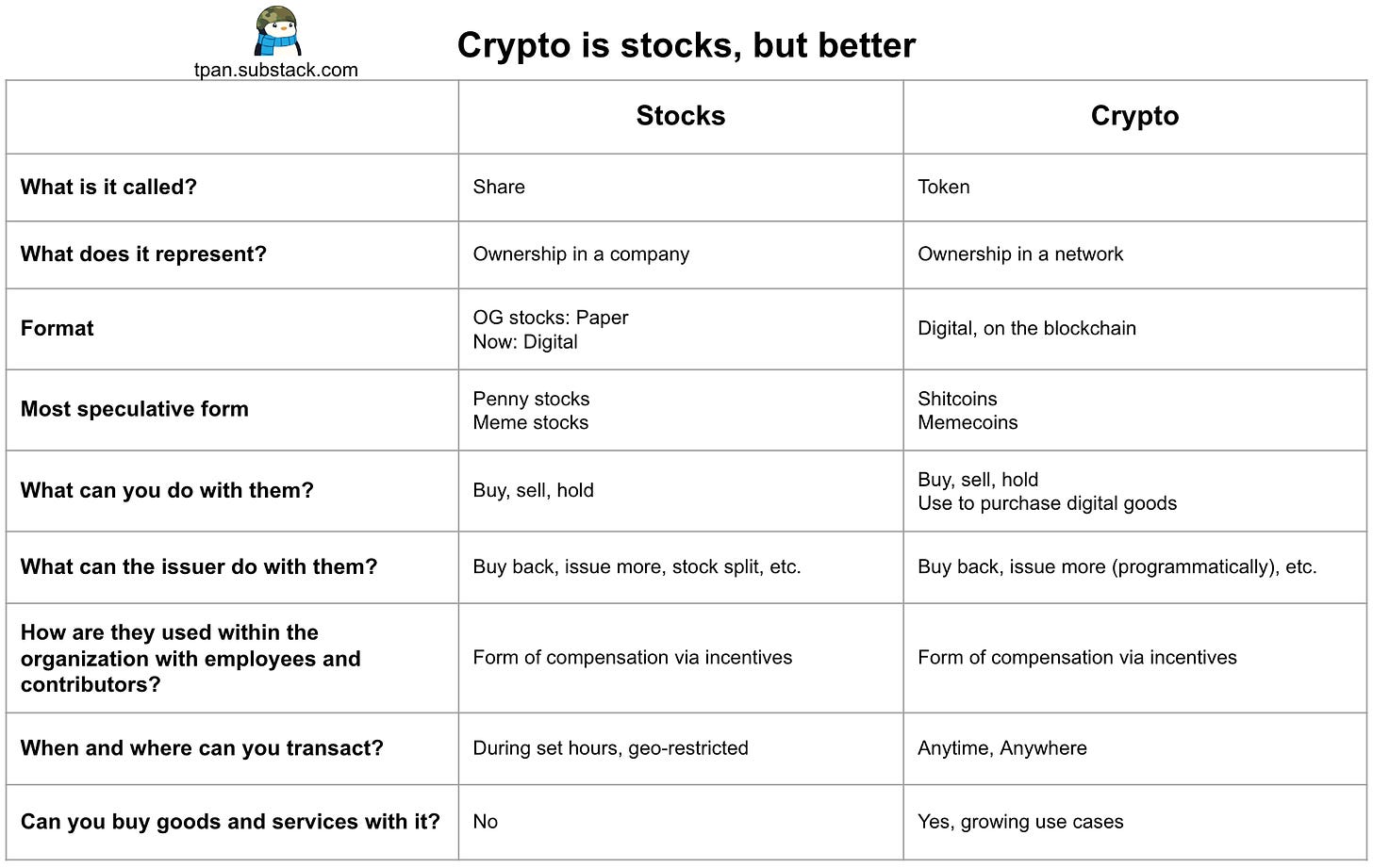

Earlier today, I realized one way to describe it is with all the technical jargon and industry buzzwords that it’s like stocks, but better. How so?

There are plenty of nuances to nitpick with the comparison, but we’re going for general comprehension, not complete accuracy. This comparison also assumes the audience understands stocks and wants to better understand crypto vs. ‘How do I make as much money as quickly as possible?’

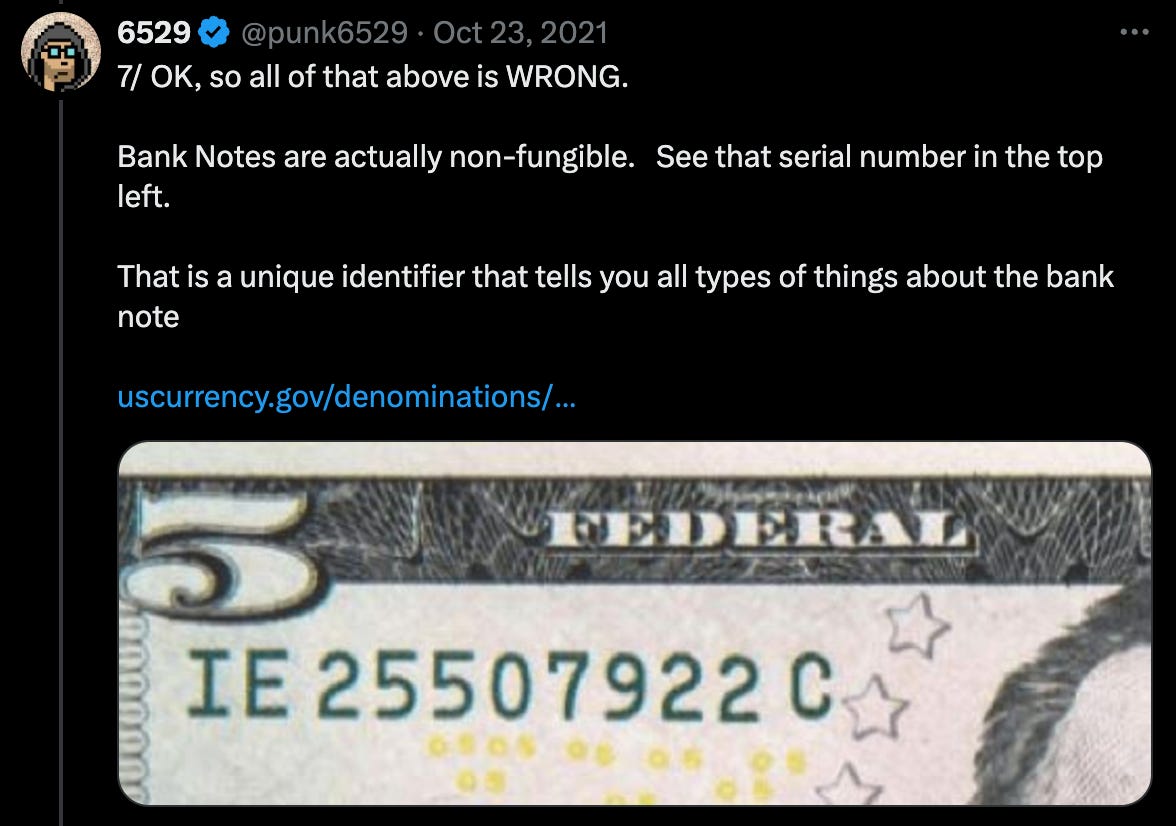

This type of explanation reminds me of 6529’s famous thread explaining what NFTs are as the NFT frenzy was in full swing. The point that made it click for me was when he clarified that banknotes are actually non-fungible.

I don’t know why it took me so long to make this comparison and have it click, but if I read something like this it certainly would have helped me have a stronger foundation as I went down the crypto and web3 rabbithole. From there, concepts like supply, governance, unlocks, decentralization, permissionless, and other industry-specific terms become easier to understand.

I’ll let you guys know if I use this analogy and how it does, and let me know if you do as well. If anything, it helps me to solidify my personal understanding even more than I did yesterday 🙂

Art as memecoins

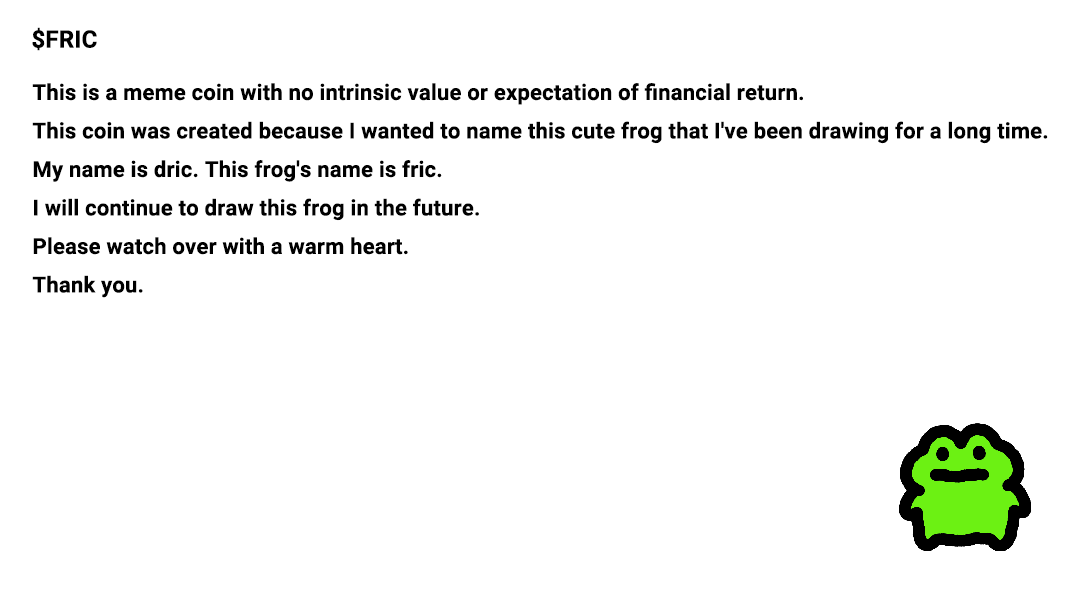

A couple nights ago I saw this cute frog on my timeline and I had to investigate, what with this lil fella doing on my timeline?!

I should’ve known, but it was a memecoin: fric the frog. But I couldn’t help it, the art style and fric are so cute. And thanks to the power of cuteness and a little research, I bought a bit of the memecoin, mentally prepared to become exit liquidity to sharper and earlier wallets. Fortunately, the memecoin is still alive, so I live to see another day (and hopefully longer).

fric is the creation of dric, a Korean artist who has been creating art for over 10 years on Instagram, amassing an audience of 664k followers. The frog character was first featured in 2020 and has turned into a main character of sorts.

And on November 24th the frog finally had a name, fric, and a memecoin to commemorate the moment.

Since the memecoin launch, dric has drawn fric in various crypto-related settings: on the Solana logo (fric on sol, good wordplay there!), with Phantom, with Moonshot, celebrating Bitcoin reaching $100k, and more.

Other artist + art focused memecoins that have ‘made it’ (using this loosely) that come to mind:

- BOOK OF MEME: $700M, created by Darkfarms

- fwog: $433M, created by Groowut

- nub: $23M

Of course there’s Pepe, the $9B behemoth of a memecoin that’s leading this cycle’s newly created memecoins, but the artist Matt Furie didn’t have a direct role in its creation.

The artist’s art-to-memecoin strategy is still an uncommon path compared to the standard mint 1/1s or series and sell them, or NFT PFP collection path. Additionally, the artists that have launched memecoins focus on a character or concept, so the pure memecoin path isn’t a good fit for many artists who don’t do character art.

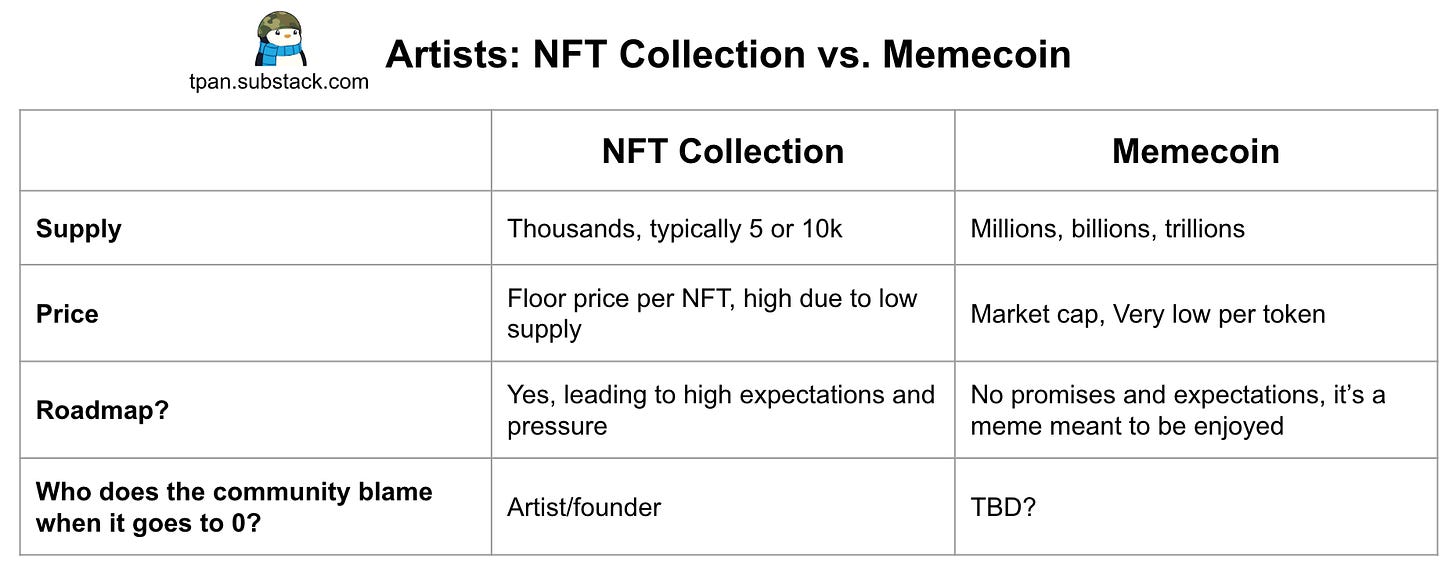

The memecoin approach makes tradeoffs with the standard NFT approach that was popular in the past, while applying lessons learned from that period.

Looking back, one key pitfall for artist-led NFT collections was that many were unprepared for the responsibilities entailed in managing a community and fulfilling a roadmap, even if there was a team helping with these functions. Memecoins remove some of these pressures, although there will always be an eternal battle around price and community expectations even if the disclaimers are made.

Another interesting observation is that there is a memecoin —> NFT collection path playing out as these two things aren’t mutually exclusive.

One notable example is fwog and its limited collection of 100 “The Pond” NFTs. fwog memecoin holders can enter a raffle for an exclusive fwog PFP for 50 fwog (~$20) per ticket.

Because of the small collection and each PFP NFT is a unique 1/1, the floor price of The Pond NFTs is currently 113 SOL (~$27K), with the next one being 161 SOL (~$38k).

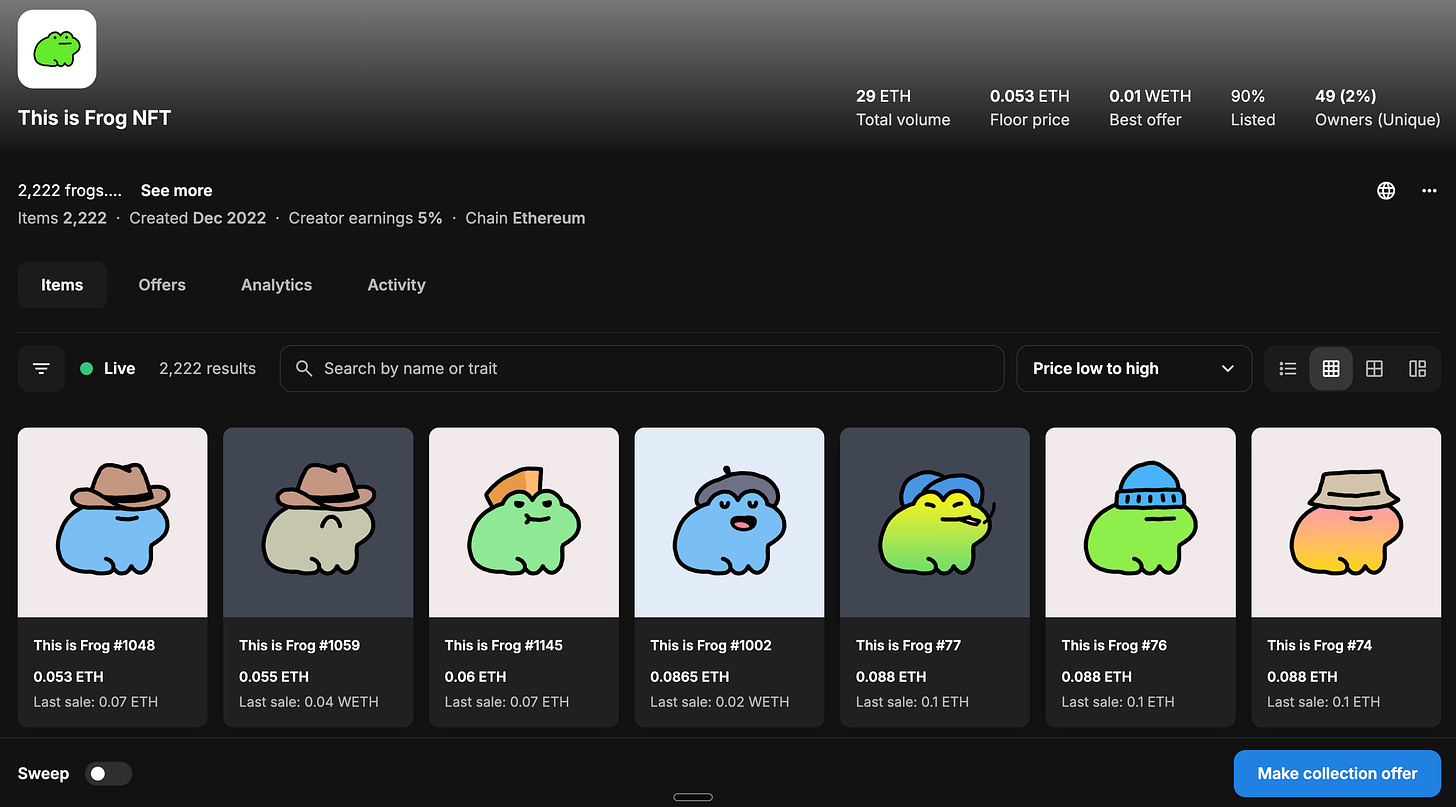

And fric is unintentionally following a similar path if the memecoin takes off. In December 2022, dric minted the This is Frog NFT, a collection of 2,222 frics, which had almost 0 sales since its creation…until the past couple of weeks when the memecoin launched.

So if fric the memecoin takes off, fric the NFT collection will eventually follow suit, which will be fun to observe.

Much of what I’m sharing here is a combination of trendspotting (and a healthy dose of confirmation bias), luck, and timing as we’re getting into the thick of a nearly up-only type of market. It remains to be seen if more artists enter the memecoin arena, which is certainly a crazy one.

But for now, there seems to be a unique window of opportunity for artists who are able to thread the needle in the way they do best: creatively.

See you next week!

All Comments