In 2023, Manta Network experienced explosive growth, characterized by remarkable advancements, groundbreaking product launches, and an unwavering commitment to innovation in the realm of zero-knowledge (ZK) technology. Serving as a revolutionary modular ecosystem tailored for ZK applications, Manta Network has achieved a significant milestone as the first EVM-equivalent ZK application platform. The ecosystem offers an unmatched experience for developing and adopting advanced web3 applications, thanks to its effective use of ZK cryptography. We'll take a look at the Manta Network ecosystem today, exploring its journey to success and what lies ahead for the network in the future.

With a Series A valuation of $500 million, Manta Network has raised over $60 million across pre-seed, seed, community, and Series A funding stages. Notable investors such as Polychain Capital, DeFiance Capital, and Qiming Venture Partners have contributed to its growth. The strategic backing from Binance Labs underscores the network's significance in the industry. Founded in 2020 by Victor Ji and Kenny Li, the founding team, operating under p0x Labs, Manta Network received initial support from a Web3 Foundation grant, marking the beginning of its journey.

Arising from a visionary initiative to surpass the constraints of current blockchain solutions, Manta Network introduces a multi-modular ecosystem consisting of two blockchain networks. These networks provide advanced ZK tooling, streamlining the deployment of ZK-applications — Manta Pacific and Manta Atlantic.

Network

Manta Pacific

Manta Pacific introduces an EVM-native Layer 2 solution with versatile ZK capabilities, enabling the exclusive creation of ZK applications through Solidity with Universal Circuits. Leveraging Celestia for DA and the OP Stack for Solidity-based ZK application development ensures not only efficient scalability but also a significant reduction in transaction fees.

The shift from Ethereum for DA to Celestia's specialized DA solution significantly reduces L2 network transaction fees, resulting in savings exceeding $1.5 million in gas fees. The upcoming developmental phase targets the establishment of a fully modular zkEVM rollup using the Polygon CDK, promising further amplification of Manta Pacific's capabilities. The transition into zkEVM utilizing Polygon CDK is set for early 2024.

Manta Atlantic

In contrast, Manta Atlantic emerges as the fastest and most decentralized ZK Layer 1 chain designed, strategically crafted to facilitate modular on-chain compliance identities through zkSBTs. Officially launched in January 2024, its primary focus lies in the ZK compliance credential layer, emphasizing practical application and seamless interoperability. This unique approach empowers projects to attain interoperable identities without necessitating direct cryptographic involvement.

Manta Atlantic establishes a composable execution environment tailored for ZK applications and seamlessly integrates Manta Network’s ZK tooling infrastructure. Built upon the Substrate framework, it operates as a parachain within the Polkadot ecosystem, placing a significant emphasis on interoperable identity verification and the deployment of ZK applications.

ZK Toolings

Universal Circuits

Manta Network's Universal Circuits revolutionize the landscape of ZK application development by addressing inherent complexities. Traditionally, developers face daunting learning curves, requiring deep expertise in cryptographic techniques and the manual creation of intricate ZK circuits using languages such as Circom.

To overcome these obstacles, Universal Circuits offer a comprehensive library of pre-built ZK circuits for seamless integration into applications, particularly those developed using Solidity for Ethereum. This approach simplifies the development process, empowering developers to incorporate ZK functionalities effortlessly, without the need for extensive cryptographic knowledge.

Functioning as ZK-as-a-Service, Universal Circuits enable Solidity developers to interact with Manta Pacific contracts via APIs, facilitating the integration of ZK features with minimal adjustments to existing codebases. Noteworthy circuit designs within Universal Circuits encompass zkContracts like zkShuffle and Semaphore-based circuits, developed by the Privacy Scaling and Exploration (PSE) Labs at the Ethereum Foundation.

Manta Network's upcoming initiatives involve enhancing Manta Atlantic's capabilities, expanding the adoption of zkSBT and MantaPay for Rust developers, and rolling out the Manta Pacific Testnet to engage a wider community of developers and applications. The aim is to broaden the network's impact and offer comprehensive solutions across both Web3 and Web2 domains.

zkSBT and Mn

zkSBTs, known as ZK-enabled SoulBound Tokens, are non-transferable NFTs anchored to individual user identities on the blockchain. Harnessing ZKPs for heightened user security, these tokens excel in on-chain gaming items, identity authentication, and asset verification. Moreover, developers can seamlessly integrate zkSBTs into ZK applications without requiring advanced cryptographic skills or expertise in ZKP.

Key Functionalities of zkSBTs:

- On-chain Data Verification: zkSBT acts as a streamlined solution for on-chain data verification, especially beneficial for mobile applications. Despite having user-friendly wallets like Particle and Unipass, validating data such as KYC details, credentials, and assets still poses challenges on mobile platforms.

- Decentralized Compliance: KYC, valued at around $1.6 trillion, is crucial for web platforms, necessitating the distinction between real users and bots. Tools like zkBAB and zkGalxe allow users to authenticate their legitimacy without disclosing personal data or linking to a wallet. Many applications leverage zkSBT for this verification purpose.

- Credential Verification for On-chain Activities: Galxe and Cyberconnect process substantial on-chain activities but struggle with privacy concerns. zkSBT provides a solution, enabling private credential verification without the need for constant wallet connections. It also supports multi-chain verification.

- Game/Social Items: zkSBTs can serve as in-game items or assets in social platforms. Notable examples include Ultiverse and ReadON zkSBTs, minted on the Manta chain and utilized across diverse applications.

- Asset Verification: zkSBTs play a crucial role in asset verification applications. Tools like POMP enable users to create zkSBTs, offering a confidential on-chain statement to verify their asset holdings. This functionality proves valuable in both traditional and decentralized financial contexts.

Manta NPO (NFT Private Offering) serves as a decentralized launchpad platform designed for minting and verifying zkSBTs. Leveraging Manta Network's zkAddress tooling and Universal Circuits, the NPO platform offers an intuitive, plug-and-play solution for seamlessly deploying zkSBTs within ZK applications. Significantly, the NPO launchpad has seen the minting of over 1.1 million zkSBTs as at the time of writing.

Manta Network’s Robust Ecosystem

Manta Network’s focus on cost efficiency and enhanced throughput for ZK applications, and has swiftly become a favored choice among decentralized applications (dApps). Since its launch in September 2023, Manta Pacific's L2 network has seamlessly integrated more than 150 dApps, with nearly 15 of them being native ZK applications.

Manta Pacific's mainnet has facilitated the processing of more than 10 million transactions since its initial debut. Despite its recent entry into the L2 scene, the network has amassed an impressive Total Value Locked (TVL) of over $1.5 billion, securing a prominent position among L2s according to L2 Beat. The significant increase in TVL can be attributed to the success of the New Paradigm bridge launch in December 2023, which brought in over 200,000 new users. Barely two months after the launch, users had bridged over $750 million in assets to the L2 network.

Manta Pacific's rollout strategy kicked off with MantaFest, a dynamic 5-week promotional campaign launched alongside its mainnet debut. This initiative aimed to invigorate network activity by introducing users to a diverse array of newly integrated dApps spanning Bridging, DeFi, SocialFi, and GameFi. Participants in MantaFest had the opportunity to accrue points, which could be exchanged for MANTA rewards during the Token Generation Event (TGE). Additionally, in October 2023, just one month following Manta Pacific's mainnet alpha launch, Manta Network unveiled the Uncharted Grants program, further fueling the ecosystem's growth and fostering innovation.

Looking Forward to the Future of Manta Network

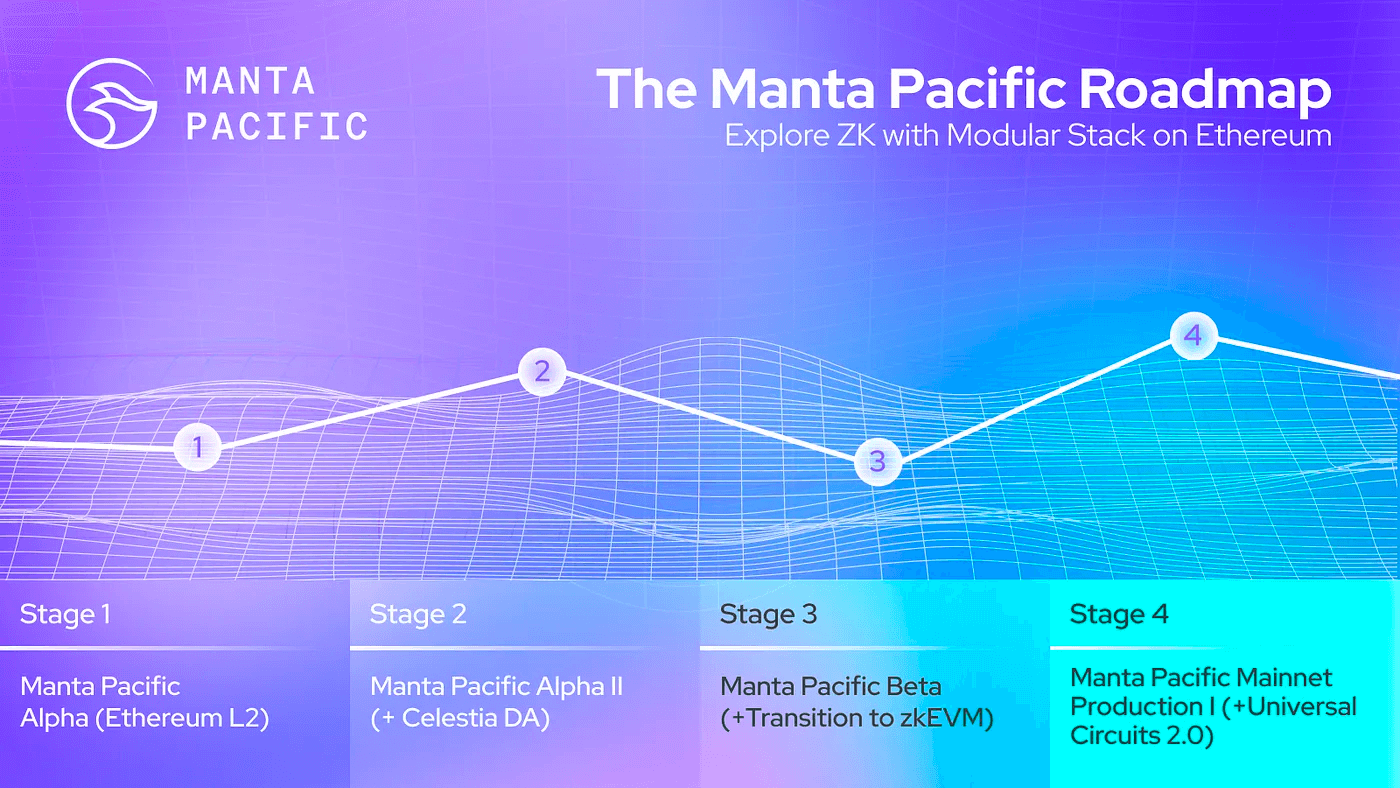

Following its mainnet debut, Manta Pacific has unveiled a comprehensive four-phase roadmap to guide its developmental trajectory following the mainnet debut. The team aims to collaboratively achieve each milestone in tandem with the broader Manta Network ecosystem and community. At present, Manta Pacific has successfully concluded the second phase, operating as an OP Stack rollup with Celestia for DA. The imminent full transition to a zkEVM validium using the Polygon CDK stands as a pivotal objective for 2024.

If Manta Network effectively executes its roadmap, it is primed to become a preferred choice for developers entering the dApp ecosystem. The ongoing evolution of Manta Network underscores a commitment to refining its offerings, expanding its influence, and bridging the web2 and web3 domains while upholding user privacy and data security.

All Comments