More than 10 years after the first application, a spate of spot bitcoin exchange-traded funds were finally approved by the Securities and Exchange Commission to begin trading in the U.S. last week. While volume has been robust, the overall crypto market is still finding out just how dynamics could change going forward and waiting to see if the decision could open the door to further spot crypto ETFs in the country.

Nansen Principal Research Analyst Aurelie Barthere told The Block that the redistribution of bitcoin's supply from whales to new entrant buyers seems likely following the spot bitcoin ETFs launch. "This probably makes the market structure less skewed towards whales," she added.

There has also been a lot of speculation about the impact of the potential new liquidity leading to lower volatility for the largest digital asset, although Aurelie saw the effect being more nuanced over the long term.

"Some studies show that higher liquidity leads to structurally lower volatility over time for an asset," she said. "For BTC , we would expect some of this effect, but, as the asset class remains speculative, large drawdowns will probably still occur in risk-off events."

Shorter-term, Barthere had anticipated a period of selling following the initial approval of the spot bitcoin ETFs but has a more positive outlook for the year ahead.

"For now, this looks like a price consolidation before resumption higher," she said, pointing to Nansen's risk management indicators, such as its "smart money stablecoin indicator" remaining risk-on crypto. The metric computes on-chain USD balances allocated by smart money wallets to stablecoins versus all coins to provide thresholds for panic and euphoria in the market, according to its website.

However, for the year ahead, the analytics firm is concerned that the U.S. Federal Reserve could disappoint markets by cutting interest rates less than expected.

"Our main concern is the divergence between the 100bps+ of Fed rate cuts expected by markets and the data that suggest that inflation may be stabilizing around 3% YoY," Barthere said. "The outlook for crypto and rate-sensitive assets becomes more ambiguous after March 2024 in our view (first rate cut priced in)."

Is a spot ether ETF next?

With the spot bitcoin ETF launches out of the way, attention turned toward another narrative for crypto markets — the prospect of a spot ether ETF in the U.S. Speculation over potential approvals this year saw the price of ether outperform that of bitcoin last week. Bloomberg ETF analyst Eric Balchunas suggested there is a 70% possibility for approval by May 23 — when the first final decision deadline for the SEC on a spot ether ETF application from Ark and 21Shares is due.

However, investment bank TD Cowen said the SEC is unlikely to approve spot ether ETFs "any time soon," and JPMorgan doesn't see more than a 50% chance of a spot ether ETF approval by May.

"The authorization of a spot ether ETF would be a strong tailwind for crypto adoption," Barthere said. "When we 'go down' the list of tokens, the question of which is a security or not becomes more ambiguous."

Uncertainties remain surrounding spot ether ETF approvals, given current SEC Chair Gary Gensler's stance that cryptocurrencies other than bitcoin are securities. However, Gensler’s predecessor, Jay Clayton, once mentioned that a small number of tokens might cease to be considered securities if they became broadly decentralized, and former SEC Director of Corporate Finance William Hinman also said in 2018 that, considering its decentralized nature, ether was not a security.

BlackRock leads spot bitcoin ETF inflows while Grayscale’s outflows compound

BlackRock filed with the SEC for a spot ether ETF in November last year, five months after it filed for its spot bitcoin ETF product in June.

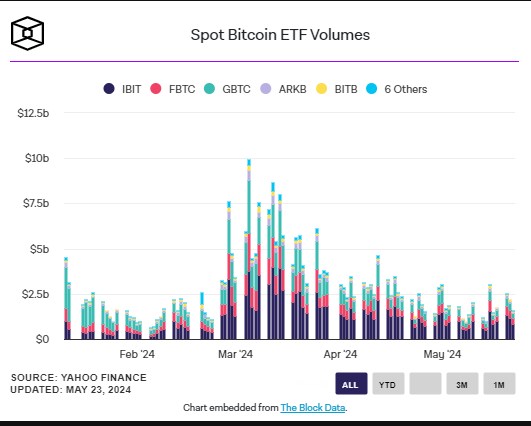

BlackRock's spot bitcoin ETF is leading in terms of fresh capital flowing into the new instruments, according to Bloomberg ETF analyst Eric Balchunas, with the asset manager recording nearly $1.1 billion worth of inflows in the first four days of trading. Fidelity is in second place in terms of flows, attracting $882 million, and Bitwise is third with $373 million. However, Grayscale has now registered over $1.6 billion worth of outflows for its converted fund in the period, with total net flows across all the spot bitcoin ETFs at $1.25 billion.

Cumulative trading volume has now reached nearly $12 billion, with total assets under management at the funds hitting $28.5 billion as of yesterday.

All Comments