From cointelegraph by Zoltan Vardai

Bitcoin has entered the “parabolic phase” of the market cycle, as analysts point at a local top of above $110,000 before the end of January.

Bitcoin price BTC$96,959 could rise above $110,000 before the end of January based on its correlation with the Global Macro Investor’s Total Liquidity Index, which offers an aggregate view of all major central bank balance sheets.

The $110,000 price tag is just a “local top” for the current Bitcoin cycle, wrote Raoul Pal, founder and CEO of Global Macro Investor, in a Nov. 29 X post:

“There have been a lot of imitations of this chart going around with the wrong phasing. Here is the updated original from our work at Global Macro Investor.”

Provided that Bitcoin price follows the liquidity index, Bitcoin’s right-hand side (RHS), which marks the lowest bid price someone is willing to sell the currency for, will peak near $110,000 in Jan. 2025 before falling below $70,000 by Feb. 2025.

Related: Bitcoin was pronounced dead 415 times, now it battles for $100K

Growing M2 money supply to fuel Bitcoin’s 2025 rally

The potential correction below $70,000 will only be temporary due to what Pal called an “interim peak in liquidity,” which he expects to continue rising into the third quarter of 2025.

The growing money supply is a historic catalyst for Bitcoin price, according to Alvin Kan, chief operating officer of Bitget Wallet. He told Cointelegraph:

“The increase in liquidity from the Fed typically enhances market conditions for risk assets like Bitcoin. Historically, such liquidity injections have led to increased investor interest and capital inflows into cryptocurrencies.”

Other analysts expect global liquidity to peak at the end of January 2026.

Based on historical data, Bitcoin could be set to absorb up to 10% of the newly printed money supply. This may attract $2 trillion worth of new investment into Bitcoin during 2025, based on a predicted $20 trillion liquidity increase.

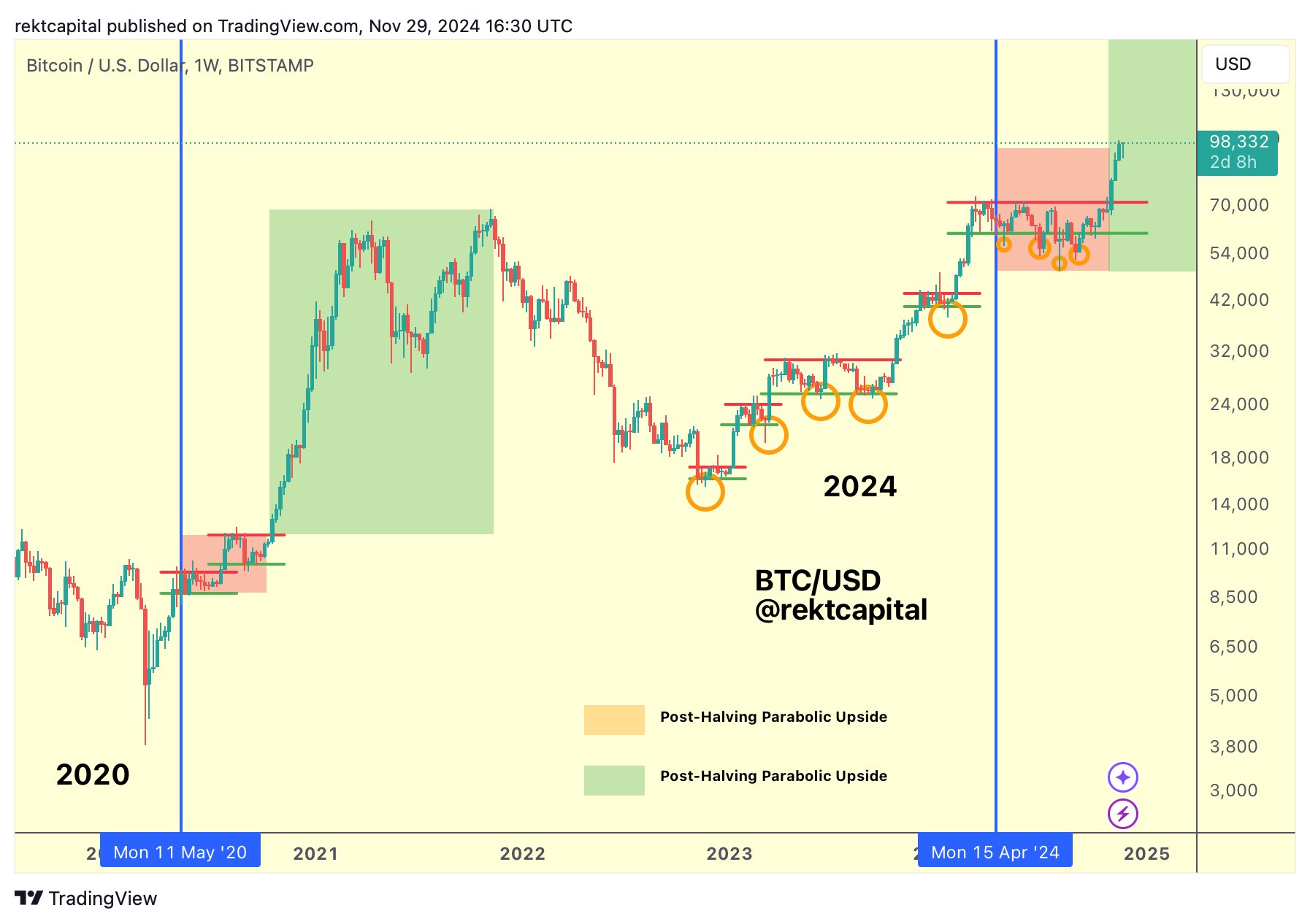

Based on the above weekly chart, Bitcoin has “fully transitioned into the parabolic upside phase of the cycle,” wrote crypto analyst Rekt Capital in a Nov. 29 X post.

Related: Bitcoin dominance hints at ‘altseason,’ analysts eye XRP price rally into 2025

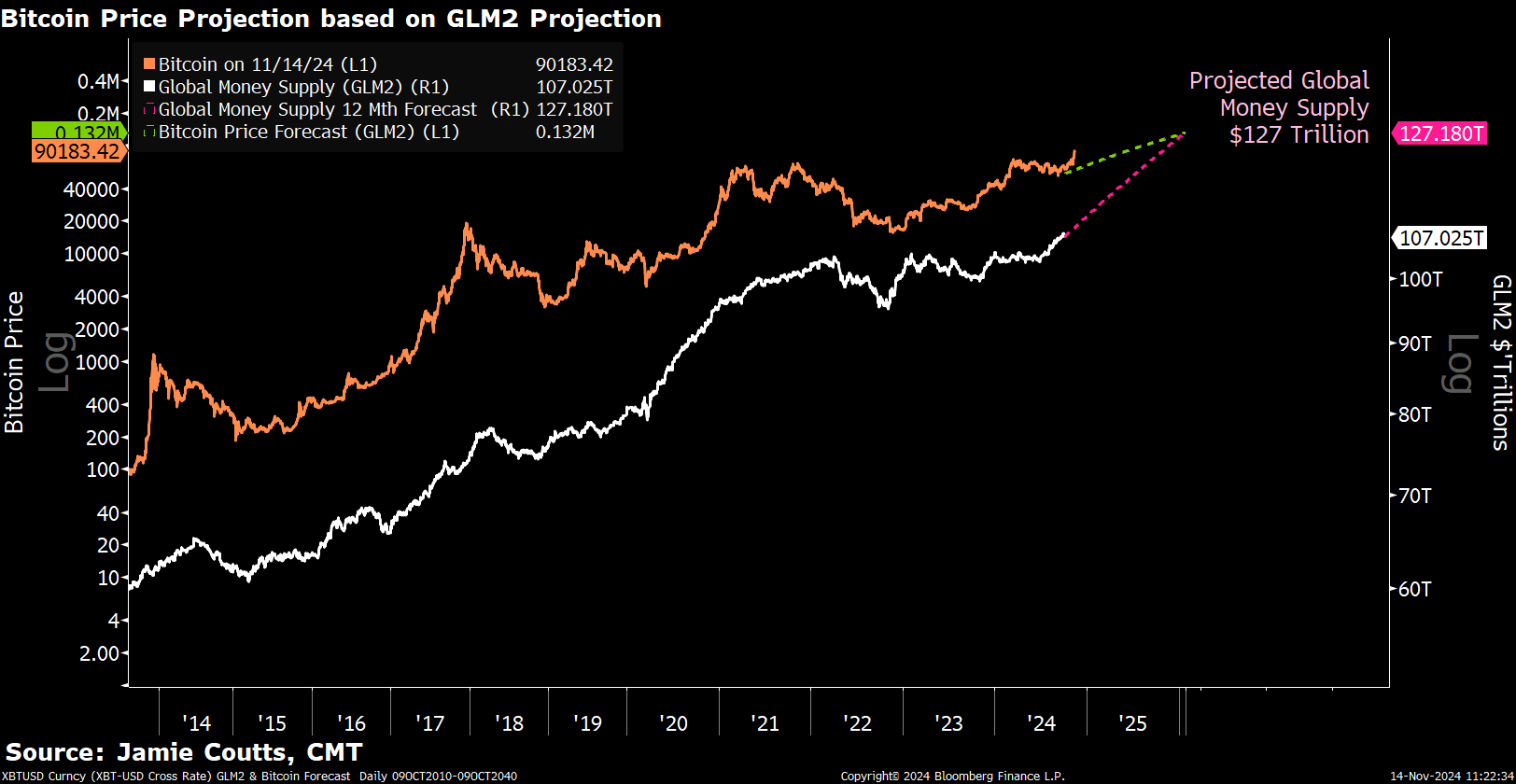

Bitcoin to reach $132,000 in 2025 on growing money supply

The growing money supply could see Bitcoin price rise to over $132,000 during next year, according to a chart shared by Jamie Coutts, chief crypto analyst at Real Vision, who added:

“Longer term, this is where I am at for this cycle; a 12-month forecast based on linear relationship with liquidity. But Bitcoin cycles are not linear. I think we go much higher than this.”

Beyond the growing money supply, Bitcoin price received a substantial boost from Donald Trump’s victory in the Nov. 5 US presidential election.

Trump’s victory inspired a new wave of risk appetite, which is expected to bolster the 2025 crypto rally. Bitfinex analysts told Cointelegraph:

“We expect all crypto assets to continue to make new highs into the new year once the Trump administration takes over and the industry benefits from an increasingly supportive regulatory environment.”

Bitcoin could hit $1 million if the Trump administration approves a potential strategic Bitcoin reserve, according to Adam Back, co-founder and CEO of Blockstream, the inventor of Hashcash and one of the most notable cryptographers in the industry.

All Comments