From Particle Network by Carlos Maximiliano Cano

TL; DR:

Overtime Markets is a decentralized, permissionless sports market on the Arbitrum, Base and Optimism L2s. It’s developed on top of the Thales protocol, a permissionless, order book-based peer-to-peer Positional Markets platform powered by Chainlink price feeds.

By integrating Particle Network’s Wallet Abstraction, Thales has created a seamless onboarding process for its users, cleverly leveraging Particle Network’s customizability to create a seamless onboarding path, particularly for mobile experiences.

Introduction

One of Web3’s remaining frontiers is delivering decentralized applications that can be consumed by the mass market. These solutions need to find unique ways to deliver access to Web3’s unique capabilities, such as fully permissionless activity, real ownership of digital assets, decentralized governance, etc.

Given this context, Web3 sports markets shine as a standout product. These platforms have a financial undertone (fitting perfectly with Web3’s current state), enable new utilities for cryptocurrencies, and most importantly, can be governed and owned by the platforms’ users, allowing them to benefit in ways only previously available to a select few intermediaries.

Overtime Markets, powered by the Thales Protocol, aims to achieve precisely this. And, knowing the importance of a growing and stable user base, the team quickly turned into two problems prevalent in Web3 user experiences: Onboarding and user retention.

How Overtime Markets leverages Wallet Abstraction

Overtime Markets understood that, to increase its chances of retaining users unfamiliar with Web3, it needed to design a straightforward process that was both mobile-friendly and provided a seamless path to using its services.

To achieve this, the team leveraged Particle’s Auth SDK to allow users to create a Web3 wallet on the spot using their social accounts and without handling private keys, a familiar process. With this in place, Thales then designed a self-onboarding process taking advantage of Particle’s Wallet-as-a-Service (Wallet Abstraction) customizability and modularity to create a fully immersive experience, also plugging into Thales’ preferred components for fiat on-ramping.

Let’s walk through this onboarding flow and its details.

Creating a seamless onboarding flow using Particle Network’s Wallet Abstraction

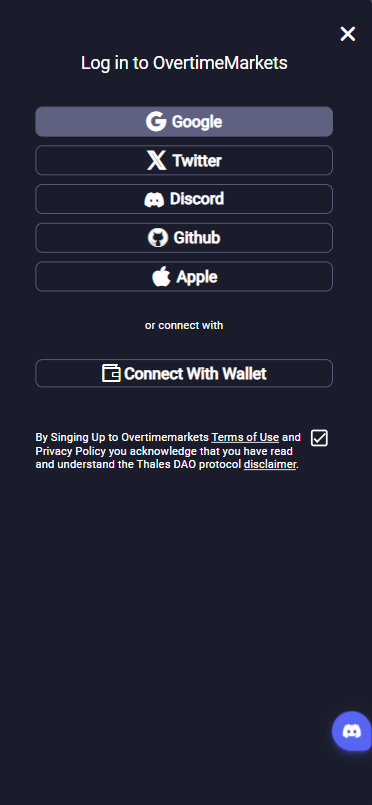

1/ The process starts once a user lands in Overtime Markets’ homepage and clicks the Log In or Sign Up button. This then allows them to either Connect a Wallet (for existing Web3 users) or, in the case most relevant to this article and non-Web3 users, connect via a social account.

Overtime Markets’ initial log-in menu.

2/ Once a new user arrives at the application and follows this process (here represented in a mobile experience) a wallet supporting all three networks supported by Overtime (Optimism, Arbitrum, and Base) is automatically created for them. Upon this, they receive only two options: to copy the address or to disconnect from the dApp.

Freshly created wallet on Overtimes Markets.

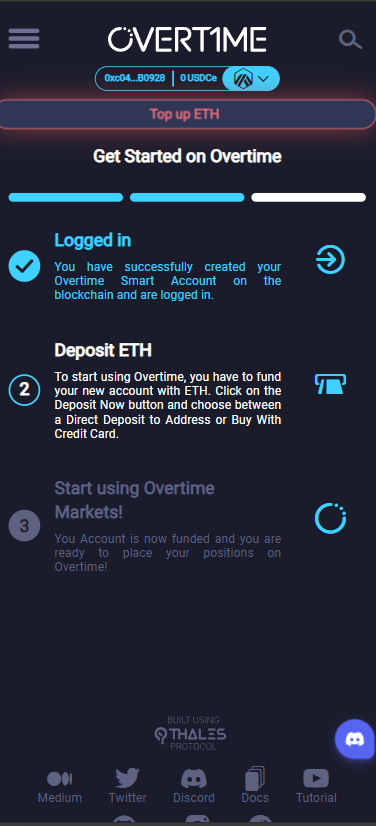

3/ Next, two options appear: “Top up ETH” and “Get Started”. The latter takes users directly to a screen showcasing where they are in the onboarding process, as well as the next steps to follow. This elegantly conveys the information users’ need and shows them what to do next.

Onboarding dashboard on Overtime Markets.

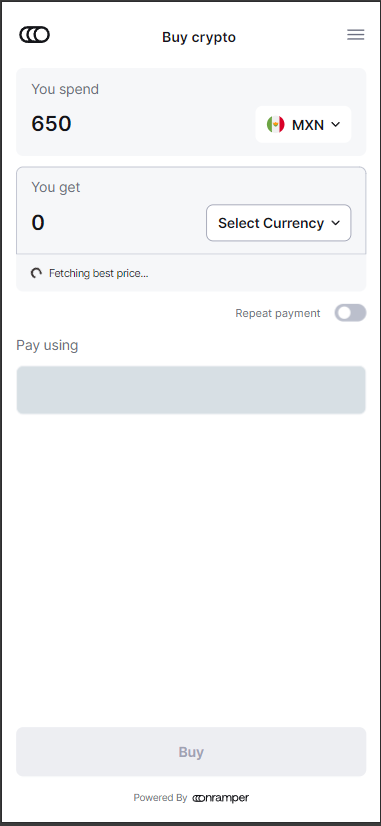

4/ Next, Overtime allows users to top up their wallets. While Modular Smart WaaS introduces its own providers for developers to simply tap into them, its modularity also allows them to introduce their own selected ones. Overtime Markets has chosen to do this, presenting users with a customized gateway to this provider by selecting to pay with a card, Apple Pay or Google Pay.

Top-up screen within Overtime Markets.

Purchasing crypto with fiat to be automatically redirected towards an address linked to Overtime Markets.

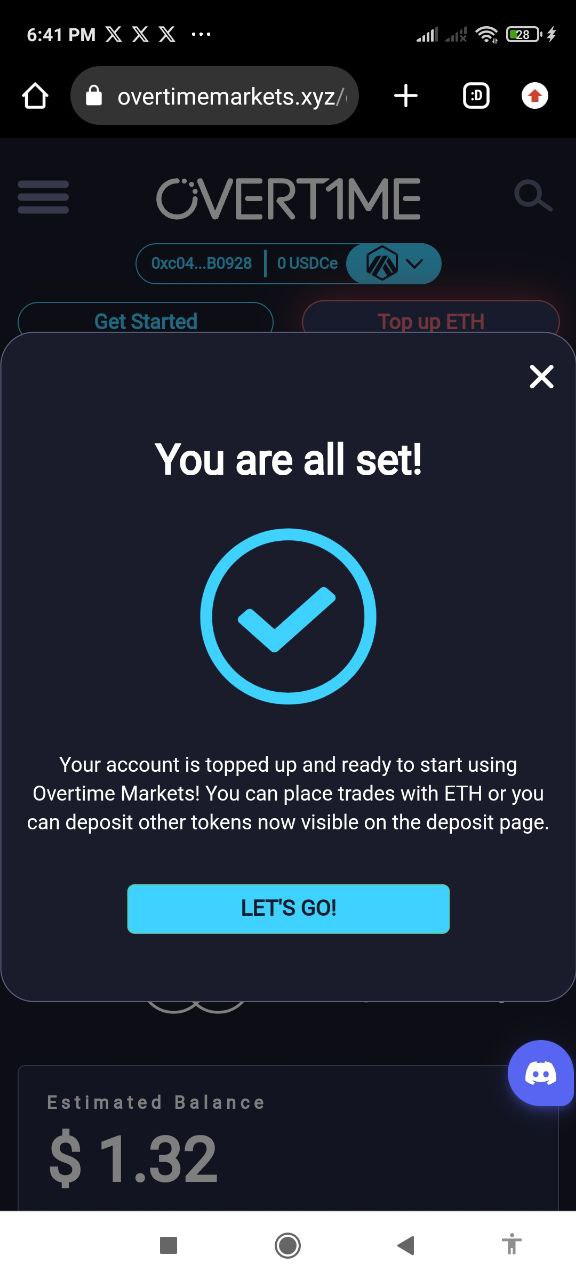

5/ Once a user has assets in their wallet, they see a confirmation screen letting them know they can start using the sports market. This completes the onboarding process.

6/ After the onboarding process is complete, users can now use their deposited funds to seamlessly place trades around sports games on the Overtime application, by confirming on-chain transactions via the integrated Particle Wallet pop-ups. This allows for any demographic of users to be able to use Overtime without needing any third-party EVM wallet or inherent Web3 knowledge, while still preserving self-custody and decentralized nature. This is all made possible by the cutting-edge Particle’s Modular Smart WaaS infrastructure.

Gearing up to leveraging Particle’s Modular L1

Importantly, Thales is also currently working on leveraging Particle Network’s Modular Smart WaaS to implement Account Abstraction solutions within Overtime Markets’ v2.

Account Abstraction enables full account programmability, allowing users to access subscription payments, gasless transactions, automated operations, and much more. Furthermore, Particle Network offers a straightforward path for developers integrating its Wallet Abstraction solutions to begin offering their users the benefits of Smart Accounts through its AA SDK.

As an additional advantage, as Particle Network releases its Modular L1 powering chain abstraction, all users of Overtime Markets v2 will be upgraded to using Universal Accounts, enabling seamless cross-chain settlement and unified addresses across chains, ushering in multiple new opportunities for the platform.

Conclusion

Overtime Markets’ integration of Particle Network’s Wallet Abstraction services highlights the importance of mobile-friendly design, wallet abstraction, and user-friendly onboarding in driving adoption.

Integrating Particle’s solutions has allowed Overtime Markets to simplify the process of onboarding users unfamiliar with Web3, making their product more accessible. This approach allows Thales to advance its goals of democratizing access and ownership of decentralized sports markets, empowering everyday users and offering them a superior experience.

Lastly, by providing highly customizable solutions, Particle Network also underscores its pioneering role in fostering inclusive, community-driven ecosystems within the Web3 landscape.

All Comments