The information, opinions, and judgments on markets, projects, and currencies mentioned in this report are for reference only and do not constitute any investmentadvice .

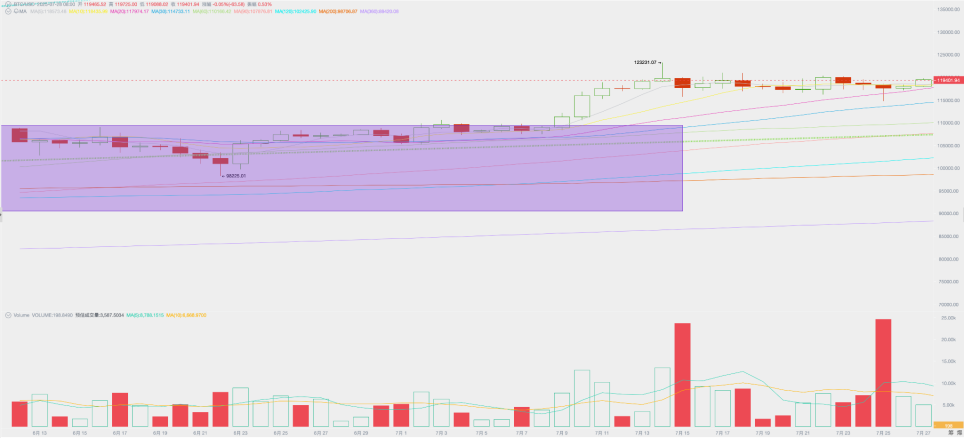

BTC opened at $117,315.68 this week and closed at $117,312.70, up 1.84%, with a high of $120,300.00 and a low of $114,750.00, an amplitude of 4.73%, and trading volume was at a high level.

US economic data released this week maintains expectations for a September rate cut, but the probability is only 64.5%. Due to the August 1st deadline for the tariff war, long-term investors continued to sell at the key $120,000 level to cash in profits. Buying power from corporate purchases and the BTC Spot ETF absorbed all the selling pressure, creating a strong buying and selling situation.

As BTC consolidated at a high level, ETH, which surged 26.4% last week, rose slightly by 3.07%, supporting the Altseason expectations. Most small-cap Altcoins fell, but high-quality projects remained strong, pushing BTC's market share down slightly to 60%.

Excluding the expectation of interest rate cuts, the factor that has the greatest impact on the market - the reciprocal tariff war - also made further progress this week. Japan and the European Union both signed a 15% tariff increase, which was generally in line with market expectations, and US stocks responded with an increase.

Policy, macro-financial and economic data

After the CPI data released last week was in line with expectations, the United States released data on Thursday on the number of initial jobless claims for the week, which was 217,000, lower than the expected 22.6 and the previous value of 22.1, once again showing the resilience of the US economy and temporarily reducing expectations of a September interest rate cut.

The preliminary reading of the S&P Global Manufacturing PMI for July in the United States, released on the same day, was 49.5, lower than the expected 52.7 and the previous value of 52.9, providing slight positive support for the interest rate cut.

US President Trump made a rare in-person visit to the Federal Reserve to demand accountability, but was met with a cold shoulder from Chairman Powell. With the Fed internally divided over whether to cut interest rates, the July 31st meeting is even more uncertain. However, the market generally believes the probability of a July rate cut is very low and has already priced it in.

In the reciprocal tariff war, clear progress was also made in the third phase (signing of the agreement) this week.

The US and Japan reached an agreement to apply a uniform 15% "reciprocal tariff" on Japanese goods imported into the US (significantly lower than the previously announced 25%-35%). Japan will invest $500 billion in the US over the next 10 years and agree to further liberalize import quotas for automobiles and agricultural products. The 15% tariff plus the combination of investment and US goods imports was lower than market expectations, leading to a 4.1% gain for the week.

The US and EU reached an agreement under which EU exports to the US (including automobiles) will be subject to a 15% tariff, while US exports to the EU will enjoy a 0% tariff. The EU pledged to invest an additional $600 billion in the US, purchase $750 billion in US energy products (primarily liquefied natural gas), and acquire significant quantities of US military equipment.

On July 25, the White House updated the draft of the Reciprocal Tariff Act, generally raising tariffs to 12%, while retaining the additional tariff range of up to 70%, and announced that it would send letters to approximately 150 trading partners before August 1 to confirm the final tariff rates.

Although major trading partners such as China, Canada and Mexico have not yet signed a final agreement, the market generally believes that the tariff war is coming to an end, and its impact on the market has given way to economic and employment data, as well as expectations of interest rate cuts.

Driven by the resilience of the US economy and expectations for AI spending, most companies reporting results during the Q2 earnings season have beaten expectations, giving investors confidence to continue buying at high levels. The three major US stock indices were stable this week, with the Nasdaq, S&P 500, and Dow Jones rising 1.02%, 1.46%, and 1.26%, respectively.

EMC Labs believes that the start of the interest rate cut cycle, the impending end of the tariff war, and AI-driven growth in US corporate earnings are the psychological underpinnings for US stocks, which have reached record highs. Similarly, fluctuations and downward adjustments in these three expectations will also create downward pricing momentum for US stocks and Bitcoin. However, systemic market risks have largely been eliminated, and a new economic cycle is about to begin.

Crypto Market

This week, BTC fluctuated between $115,000 and $120,000, with the 5-day and 10-day moving averages sticking together, and it briefly retraced to the 20-day moving average.

In previous reports, we pointed out that BTC had started the fourth wave of growth in this cycle, but returned to a volatile trend after challenging $120,000. The reason was that after the sharp rise in early July, the bullish momentum weakened due to the uncertainty of the tariff war on August 1, coupled with the continued selling of long-term investors, which led to a pause in the rise.

Long-term reduction of holdings is not necessarily all negative. Whether on or off-market, we have noticed that funds are rapidly flowing into Altcoins led by ETH.

The crypto market is in a period of intra-cyclical reversal, marked by a reversal in the ETH/BTC trading pair. Bitcoin's subsequent gains have been driven primarily by corporate purchases and inflows into the BTC Spot ETF channel.

Capital inflows, outflows, and selling

The fourth wave of rise started, and long-term holders started to sell off on a large scale again. In the past three weeks, the scale of selling exceeded 190,000 coins, causing the destocking of centralized exchanges to slow down.

In particular, the awakening and selling of ancient whales has exerted great psychological pressure on the market. In the absence of sufficient buying power on the market, the strong buying power outside the market has provided strong support for the BTC price.

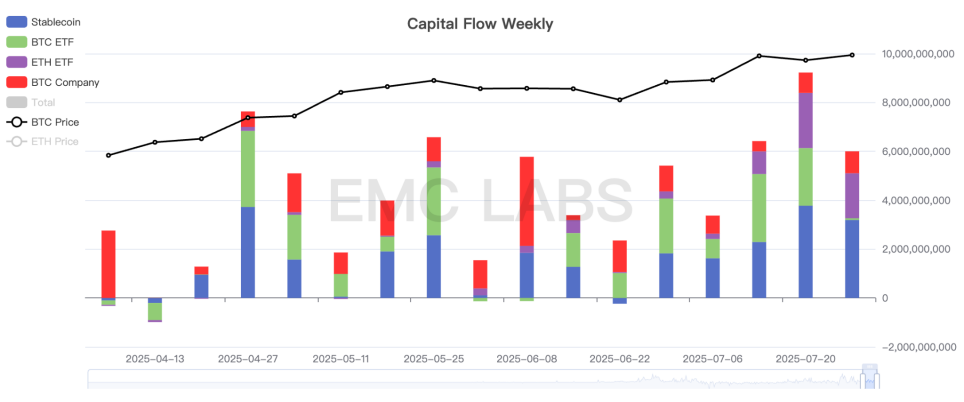

This week, the total market capital inflow reached US$6.002 billion, of which 3.192 billion went to the stablecoin channel, 702 million went to the BTC Spot ETF channel, 898 million went to corporate purchases, and 1.842 billion went to the ETH Spot ETF channel, once again exceeding the buying power of the BTC Spot ETF.

Two changes occurring in the OTC market are the rise of corporate purchases as the primary force, and the shift of ETF funds from BTC to ETH. These two developments warrant close attention.

Cycle indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0.5, which is in an upward phase.

EMC Labs was founded in April 2023 by cryptoasset investors and data scientists . Focusing on blockchain industry research and secondary crypto market investments, and leveraging industry foresight, insight, and data mining as core competencies, EMC Labs is committed to participating in the booming blockchain industry through research and investment, and promoting the benefits of blockchain and crypto assets for humanity.

For more information, please visit: https://www.emc.fund

All Comments